Navigating The Complexities of Sanctions on Syria

At Karam Shaar Advisory, our Sanctions Program helps humanitarian, civic, and policy actors navigate what sanctions relief means

At Karam Shaar Advisory, our Sanctions Program helps humanitarian, civic, and policy actors navigate what sanctions relief means

China’s 2025 engagement in Syria was capital-light. Why did private firms move first while Beijing stayed cautious? Get our

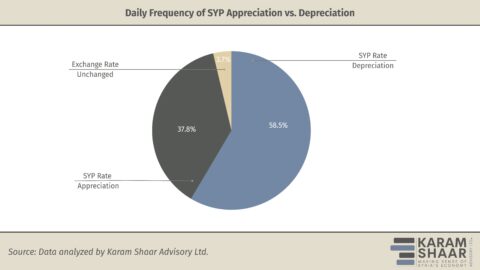

Facing rising exchange-rate volatility in 2025, Syria’s Central Bank turned to new policy tools. The unification of official rates,

In this issue, we cover: – US sanctions over Raqqa fighting: Senator Lindsey Graham warns that continued clashes

Presidential appointments are a critical corrective mechanism. Can they fix what elections left unresolved? See full analysis. Get these

Political announcements triggered sharp but short-lived SYP appreciations. Why did optimism fade so quickly each time? Read more here.

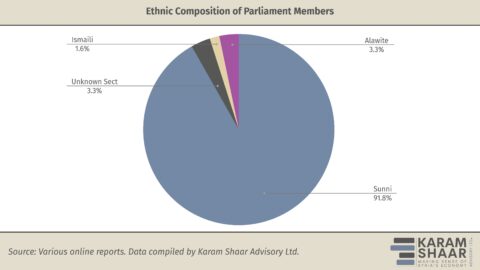

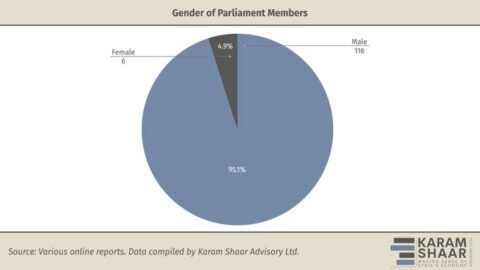

Women and minorities are severely underrepresented in the new Assembly. Why did the elections produce these imbalances? Get our

Women and minorities are severely underrepresented in the new Assembly. Why did the elections produce these imbalances? See full

The issue is not that some MoUs will fail, but that several were never credible to begin with. Dr

Our mapping highlights significant gaps in the ethnic and gender representation. Here‘s why President Al-Sharaa’s incoming appointments matter.