Captagon in 2024: Implications After the Fall of the Syrian Regime

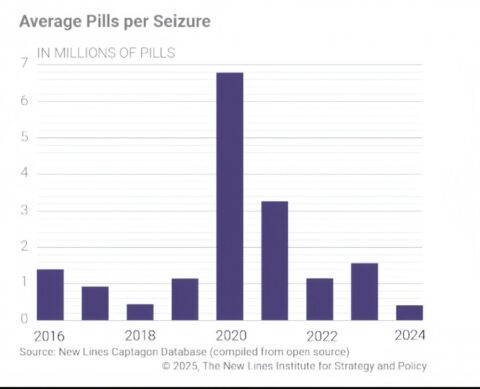

In Feb 2025, New Lines Institute published a report by Karam Shaar, Roaa Obeid & Caroline Rose on how the Assad regime lowered the

In Feb 2025, New Lines Institute published a report by Karam Shaar, Roaa Obeid & Caroline Rose on how the Assad regime lowered the

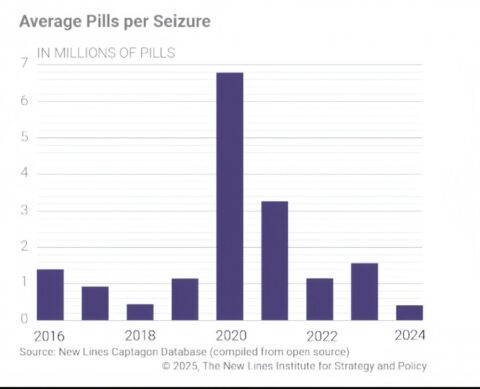

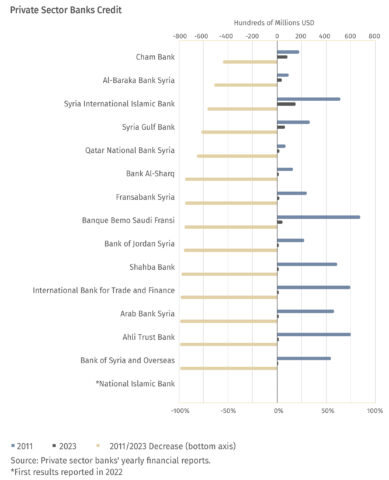

Our data shows 57% of the caretaker government ministers have been affiliated with the Syrian Salvation Government (SSG)—HTS’s administrative extension.

Read the full interview in Issue 6 of Syria in Figures. Read On X

The US military and intelligence community are engaging with Syria’s interim government, yet Trump’s White House sees no justification for

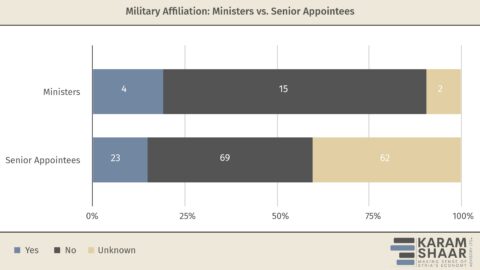

Syria’s private banking sector has faced near-total collapse since 2011, driven by sanctions, de-risking, and the loss of correspondent banking

How to dismantle Assad’s crony capitalism? With figures like Rami Makhlouf, the Katerji family, and Samer Foz controlling key sectors,

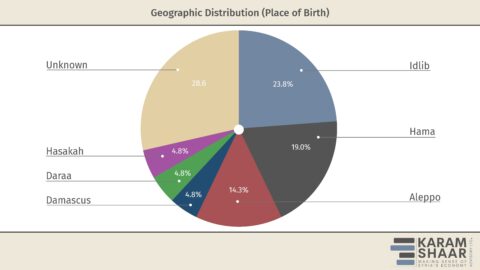

What does Syria’s Caretaker Government reveal about its future? Our analysis of 21 ministers and 154 senior appointees shows: –

In this issue: Syria’s caretaker government – Who’s who and why its composition matters. The state of Syria’s domestic debt

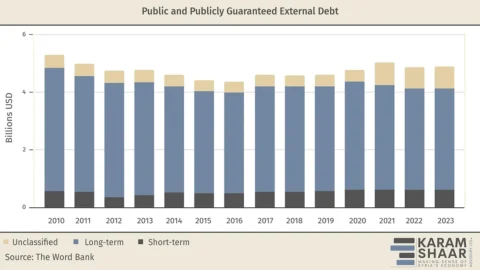

Syria’s external debt is a puzzle. While official figures suggest $30B owed, leaked Iranian documents put the real debt at