Syrian Oil Exports, Budget Revenues, and Reserves

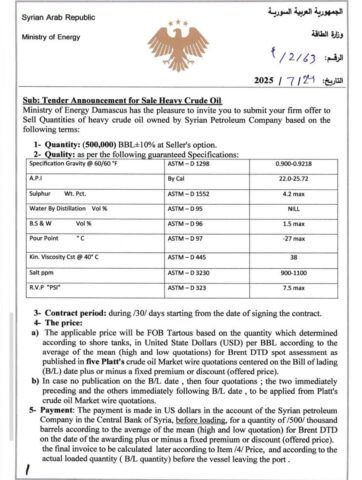

Syria’s current oil strategy appears to focus on exporting heavy crude, due to the aging infrastructure. Mohamad Ahmad, an economist

Syria’s current oil strategy appears to focus on exporting heavy crude, due to the aging infrastructure. Mohamad Ahmad, an economist

The minister says the country is building a data corridor linking Europe and Asia, inviting global tech giants to invest

Speaking to Raseef22, our Economist, Mulham Aljazmaty, underlined the dual meaning of Syria’s currency reform. From a symbolic perspective, he

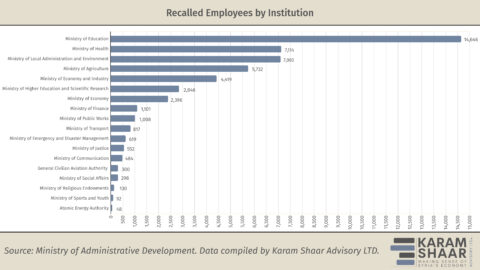

2025 brought major shifts: • 50,000 civil servants expelled under Assad reinstated. • Corrupt, absent, and other employees dismissed, sparking

After Assad’s fall, the interim government is struggling to rebuild a broken bureaucracy: • Payroll cleanup: A new employee database

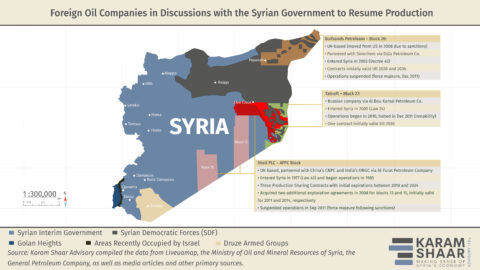

Momentum is building, with talks involving the Syrian government and international companies such as Shell, Tatneft, and Gulfsands, among others.

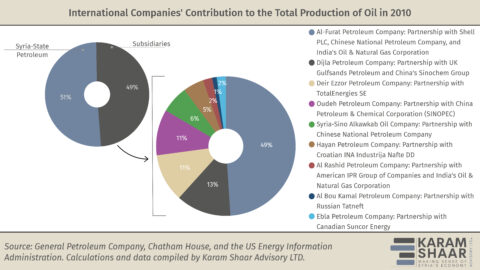

After more than a decade of sanctions and war, Syria’s oil sector is reopening. Before 2011, foreign firms produced nearly

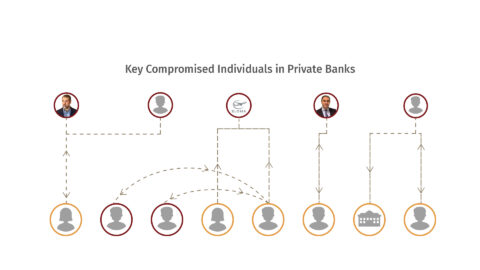

Eight highly compromised individuals, either sanctioned or closely tied to Assad regime cronies, hold shares in more than half of

Syria’s private banking sector urgently needs international re-engagement. Yet a handful of sanctioned shareholders continue to block the path. Under

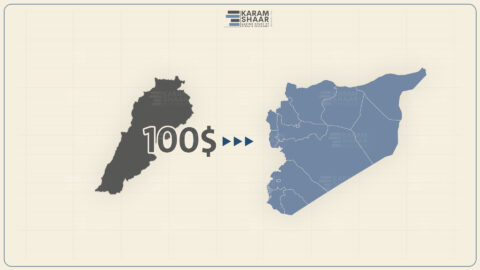

Lebanon has announced a plan to repatriate 400,000 Syrian refugees, offering $100 per person. Cyprus offers over €1,000 per family.