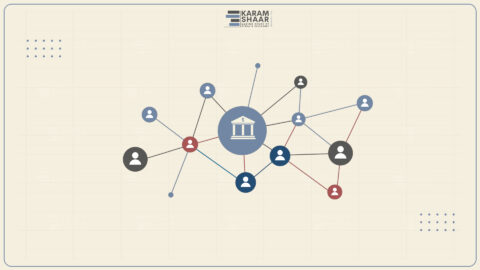

Eight highly compromised individuals, either sanctioned or closely tied to Assad regime cronies, hold shares in more than half of Syria’s private banks. Though these are minority stakes, the situation undermines efforts at international re-engagement.

For foreign correspondent banks, the presence of compromised individuals means higher compliance costs in a country where the financial incentive for re-engagement remains too small to justify the risk.

Suggested remedies:

Use court rulings or presidential decrees to freeze or confiscate the shares of sanctioned shareholders.

Introduce legal measures to safeguard private banks and demonstrate a clear break from Assad-era practices.

Encourage Syrian private banks to coordinate and jointly press for these reforms.

Don’t miss the full analysis!