Turning the Tax System on Its Head: Assessing Syria’s New Fiscal Reform

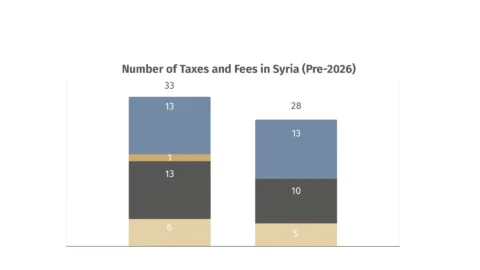

Syria’s 2026 tax reform swaps a fragmented system with flat rates and high exemptions—but our assessment warns it risks deepening fiscal vulnerability despite its advantages.

Syria’s 2026 tax reform swaps a fragmented system with flat rates and high exemptions—but our assessment warns it risks deepening fiscal vulnerability despite its advantages.

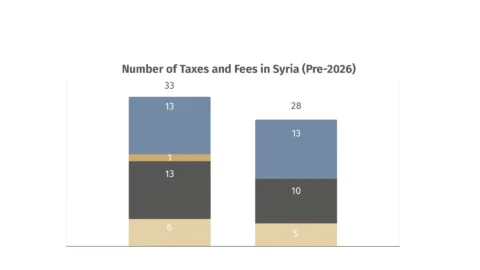

Withdrawal limits have frozen Syrians’ bank deposits, fueling a parallel market where balances are sold at steep discounts. Our analysis exposes this system and its repercussions.

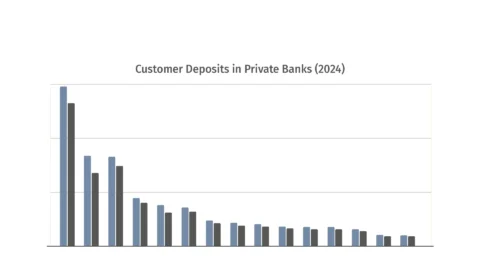

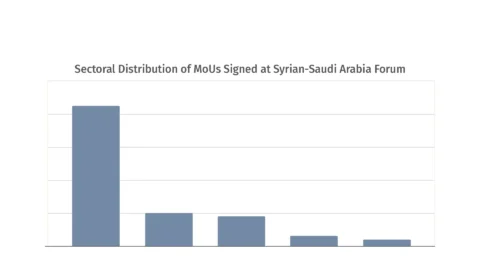

The first detailed mapping of Syria’s USD 25.4 billion post-Assad MoUs highlights their scale and distribution, while underscoring the risk for implementation.

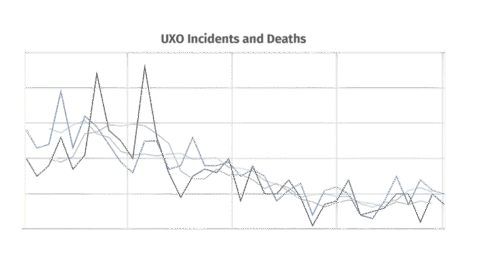

Syria faces the world’s most severe UXO crisis, with 2025 deaths projected to nearly triple the average of the past 13 years. A national body is urgently needed to coordinate clearance with international partners.

Syria and Lebanon: Borderlands as Catalysts for Development and De-escalation in the Levant

Assad’s fall and Hezbollah’s weakening create a rare opening in Syria–Lebanon ties. This analysis shows how turning borderlands into economic corridors could foster stability.

Governor Al-Gharib outlines his vision for Aleppo, addressing administrative transparency, financial management, reconstruction priorities, and investment strategies to balance urgent needs with long-term development.