Syria’s new tax overhaul touches every Syrian:

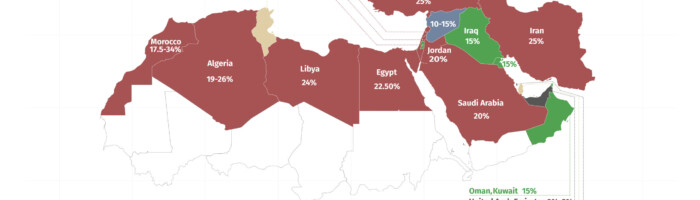

– Income tax: More than 90% of Syrians will be exempt, with the top rate capped at just 8%.

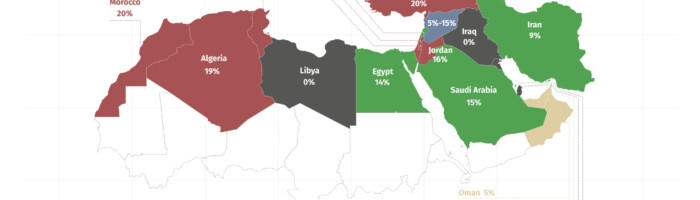

– Corporate tax: Companies will face flat rates of 10% or 15%, among the lowest in MENA.

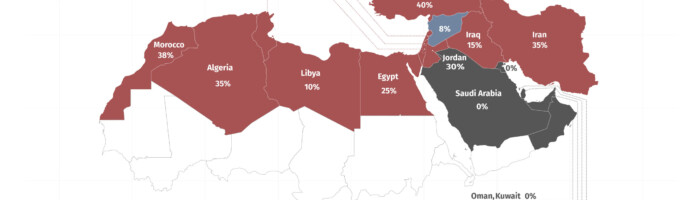

– Sales tax: A new VAT-like regime imposes 5% on most goods and up to 15% on luxuries.

That means major relief for households and businesses, but it also means a sharply narrowed tax base. Can Syria maintain public services, rebuild infrastructure, and meet post-war needs with such limited revenue?

See the regional comparison maps above for how Syria’s proposed rates stack up on income, corporate, and sales taxes.