The Syrian Pound: A Year of Signals and Volatility

- Issue 15

Following a year marked by profound political and economic shifts in Syria, the exchange rate of the pound (SYP) remained the most immediate and telling proxy for the country’s pervasive uncertainty. Throughout 2025, the pound experienced fluctuations reflecting the fragility of the monetary environment and the market’s acute sensitivity to political and policy announcements. This article examines the factors that shaped the pound’s movements and assesses the outlook.

The analysis draws on a quantitative review of 380 daily exchange-rate observations, covering the period from the start of the military operation against the Assad regime in November 2024 through mid-December 2025, sourced from our live tracker.

From Announcements to Dynamics: Interpreting SYP Volatility

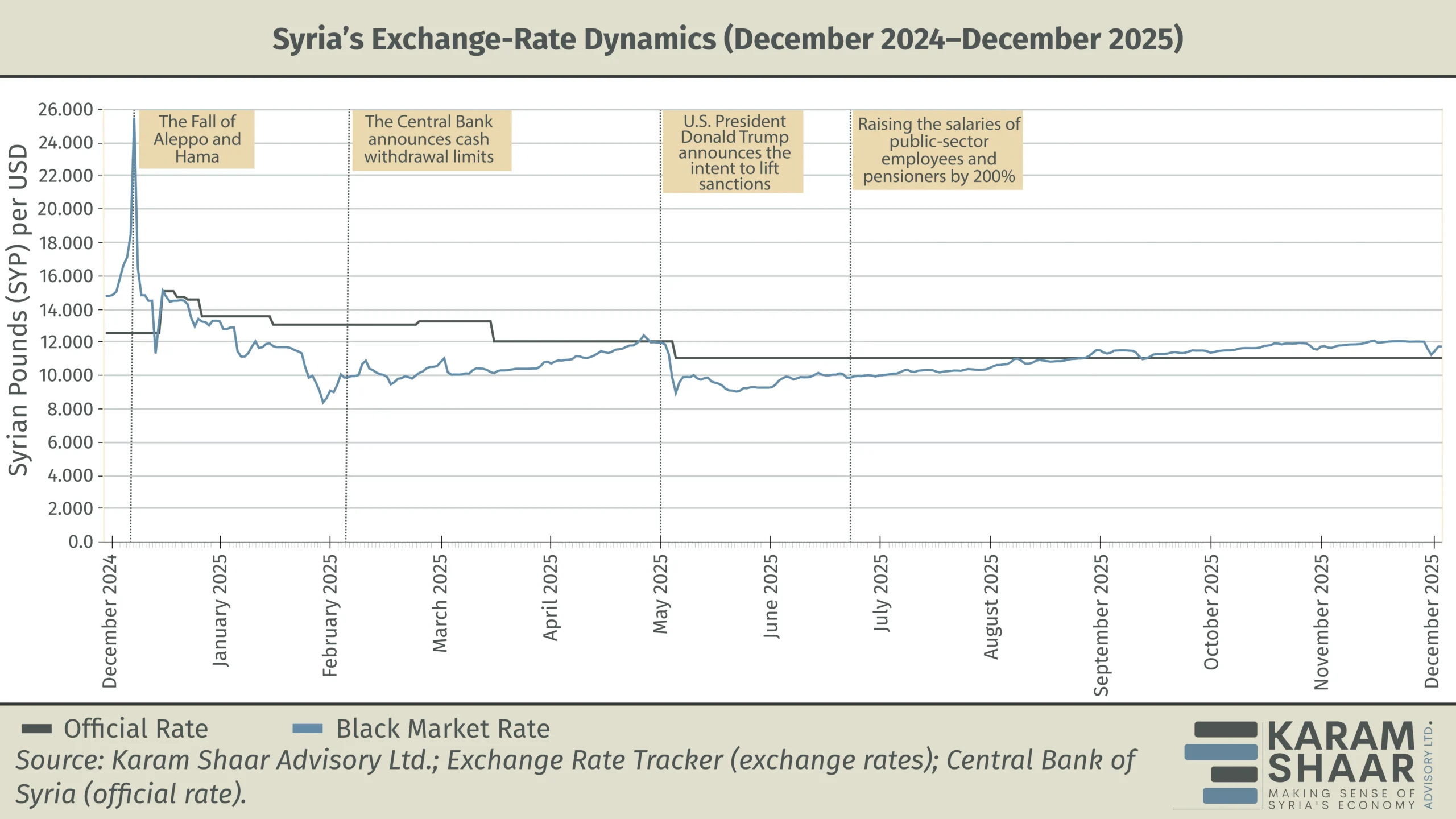

In the final weeks of 2024, the pound experienced rapid depreciation in the wake of the military operation that led to the collapse of the Assad regime, as the country’s outlook appeared more uncertain than ever. After months of relative stability at around SYP 14,750 per USD in the second half of 2024, the pound weakened sharply, reaching SYP 25,000 against the dollar on the eve of the regime’s collapse.

On 9 December 2024, the day following the collapse, the new authorities announced that all bank deposits were “safe and protected,” lifted long-standing restrictions on foreign-currency trading, and eased domestic trade by removing crossings between the northwest and formerly regime-held areas. As conditions began to stabilize by the end of the year, the SYP recovered to around 14,000.

At the start of 2025, the SYP continued to appreciate. While the legalization of USD-denominated transactions, stabilizing political and security conditions, and the steady return of refugees likely contributed to an increase in the supply of foreign currency, these factors were more than offset by others. Chief among them was a spike in imports driven by pent-up demand following the easing of import financing restrictions, alongside an emerging SYP cash shortage. The latter reflected the monetary authorities’ difficulties in reasserting control over cash-dominant hawala companies that had long been affiliated with the Assad regime, pushing the black-market rate to around SYP 10,000 per USD by the end of January.

In February, the Central Bank addressed the cash crunch by imposing strict cash-withdrawal limits and suspending salary payments for public-sector employees for more than two months. These measures contributed to a further appreciation, with the black-market rate reaching SYP 8,658 per USD.

As the new authorities regained de facto control over the hawala market—leading to the resumption of operations for some entities and the suspension of others—the sharp increase in demand for foreign currency to finance imports continued to outweigh the increase in supply, which stemmed primarily from refugee and expatriate returns. These dynamics led the exchange rate to revert slowly but steadily to around SYP 12,000 by May.

On 13 May 2025, US President Donald Trump announced his intention to lift sanctions on Syria, triggering strong optimism in the market. The SYP appreciated by more than 20% over two days. This surge, however, quickly dissipated. By 19 May, the exchange rate had returned to near SYP 10,000 per USD as the initial shock faded.

On 11 December 2025, a similar short-lived appreciation episode followed announcements related to the repeal of the Caesar Act, when the SYP strengthened by around 6.5% in a single day before retreating over the subsequent two days.

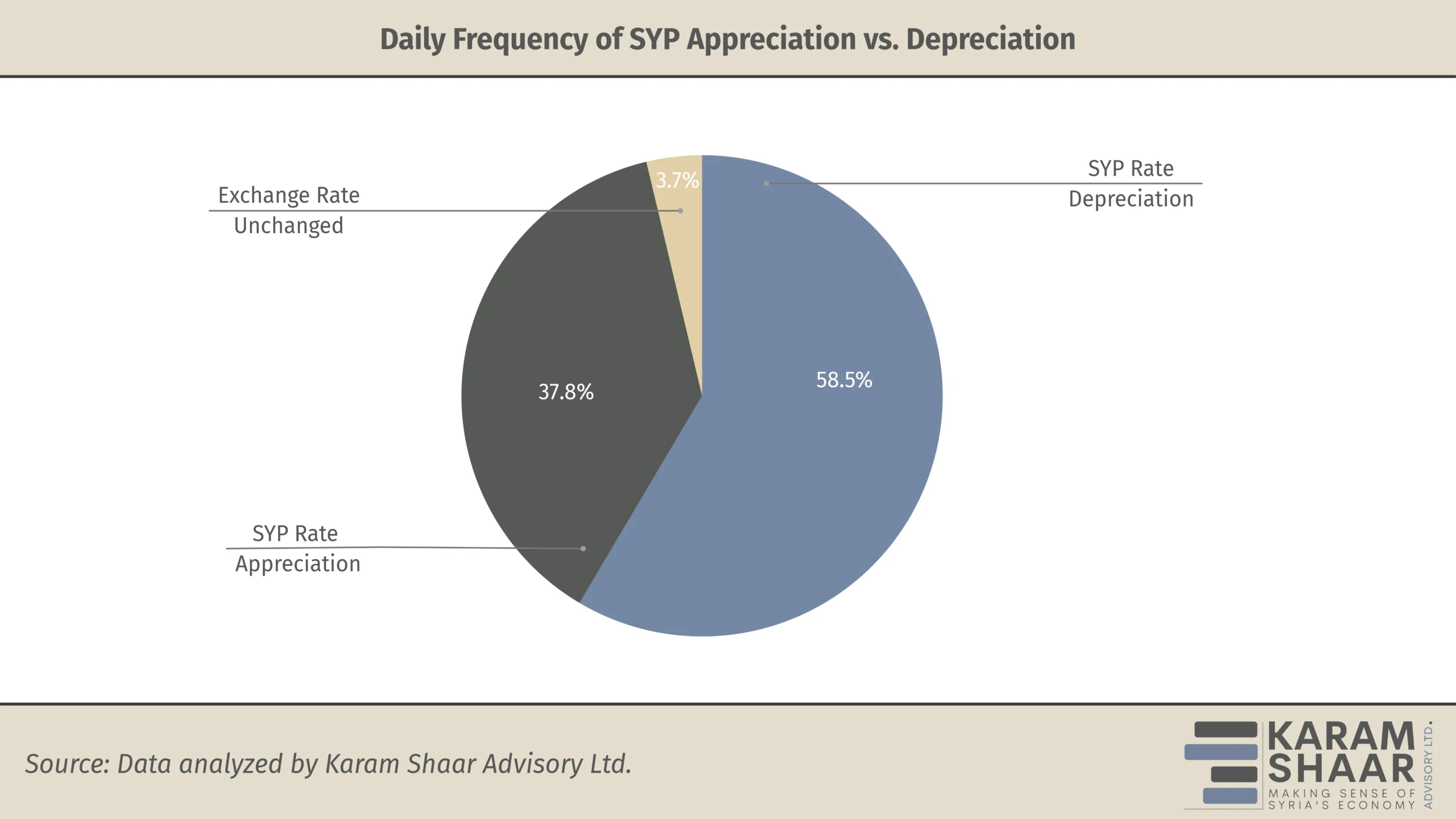

This pattern has repeated throughout the period under review. Over the past 380 days, and despite an overall appreciation trend, the currency recorded 219 day-on-day depreciations compared with 142 days of appreciation. This suggests that appreciation episodes, while fewer, were significantly more pronounced and were typically triggered by short-lived sentiment shocks such as those described above.

On balance, economic fundamentals have been pointing toward depreciation. Persistent controls on cash supply in the cash-dominant economy are likely to have played a key role. This trend has also been reinforced by two additional factors. First, the widening trade deficit, which is raising the demand for USD. Second, since 22 June, public-sector salaries and pensions have been increased by 200%. This decree injected 19.2 trillion into the economy—nearly half of the overall money supply (M2, according to figures seen by our Advisory)—generating a resurgence in inflation. As a result, the SYP began a slow but steady depreciation from July onward, as the actual increases started to feed through and translate into spending.

Outlook

The outlook for the Syrian pound remains highly uncertain. In the absence of sufficient foreign reserves and effective monetary policy tools, such as interest rate setting and open market operations, exchange-rate dynamics are likely to continue to depend more on liquidity conditions than on the Central Bank’s stated objectives, whether under the declared managed floating regime or otherwise. Absent a policy shift, the trade deficit is likely to continue exerting quiet but steady pressure on the SYP, resulting in further depreciation, as the production base cannot expand as rapidly as imports under easing restrictions on the flow of goods.

At the same time, psychological factors and policy announcements are expected to continue driving short-term fluctuations. These may include developments related to the potential removal of the State Sponsor of Terrorism designation in the US in early 2026 or the lifting of the Lebanon Sovereignty and Syria Accountability Act.

Depreciation is likely to accelerate further following the removal of cash-withdrawal restrictions. However, this effect is expected to be largely one-off, as locked-up deposits are released, resulting in a level correction.