China’s Asset-Light Approach in Syria’s Transition

- Issue 16

Trade and investment data from 2025 indicate a bifurcated Chinese approach toward Syria. While Beijing remains diplomatically cautious and continues to condition large-scale engagement on security guarantees, private Chinese firms have begun to test the market. Disaggregated customs data show a Q4 2025 surge in commercial inflows, reflecting in part a shift from Turkish land routes to direct maritime shipping. At the same time, private entities have engaged in limited management contracts for industrial zones.

This activity does not amount to a state-led reconstruction effort. Despite more positive rhetoric, Beijing’s posture remains constrained by security risks, the Syrian government’s aversion to loans, and weak fiscal and market conditions, which together cap the depth of near-term China–Syria economic ties.

Signs of Increased Commercial Presence

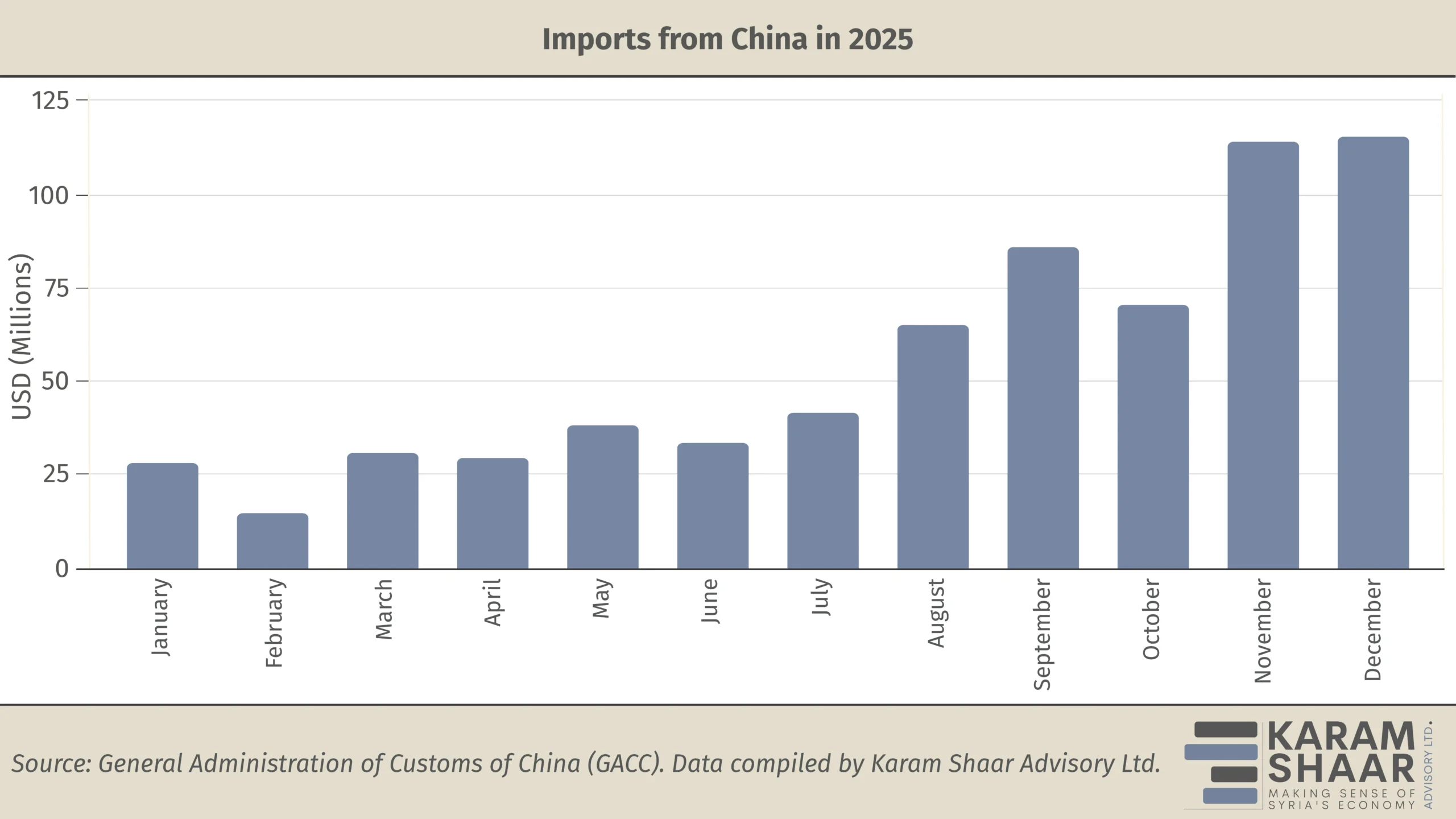

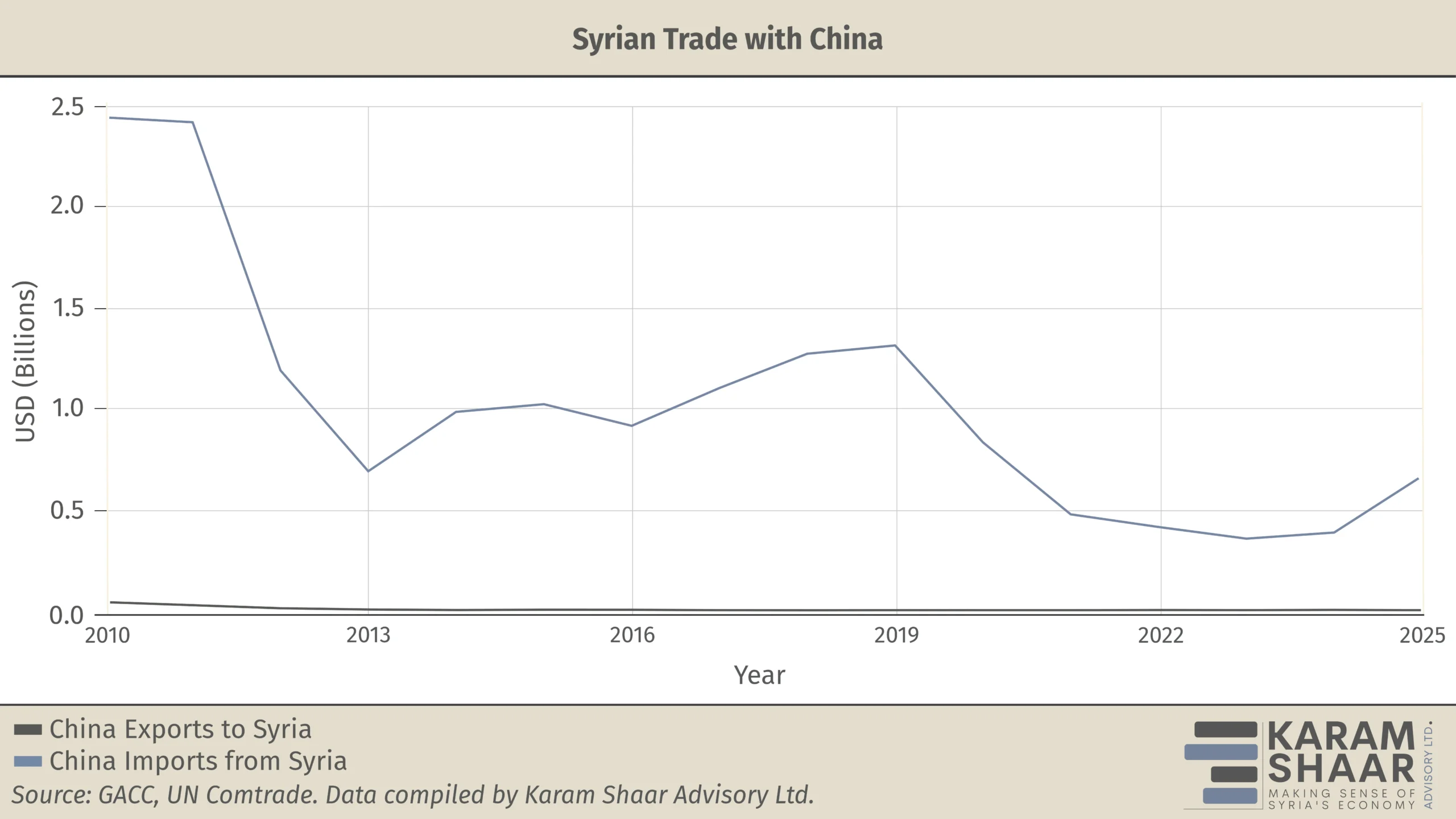

China’s direct market entry accelerated in the fourth quarter (Q4) of 2025. Data from the General Administration of Customs of China show that total exports to Syria reached USD 668.1 million for the year, driven by a sharp Q4 increase. Monthly exports rose from an average of about USD 30 million in the first half to USD 115.5 million in December. Despite this rebound, bilateral trade remains far below 2010 levels of roughly USD 2.4 billion.

The relationship remains highly asymmetrical. Syrian exports to China totaled only about USD 1.26 million in 2025, less than 0.2 percent of the value of Chinese exports to Syria. This imbalance reflects Syria’s long-standing dependence on imported consumer goods, now compounded by a war-ravaged production base and looser trade barriers.

Consumer Goods and Spare Parts Dominate

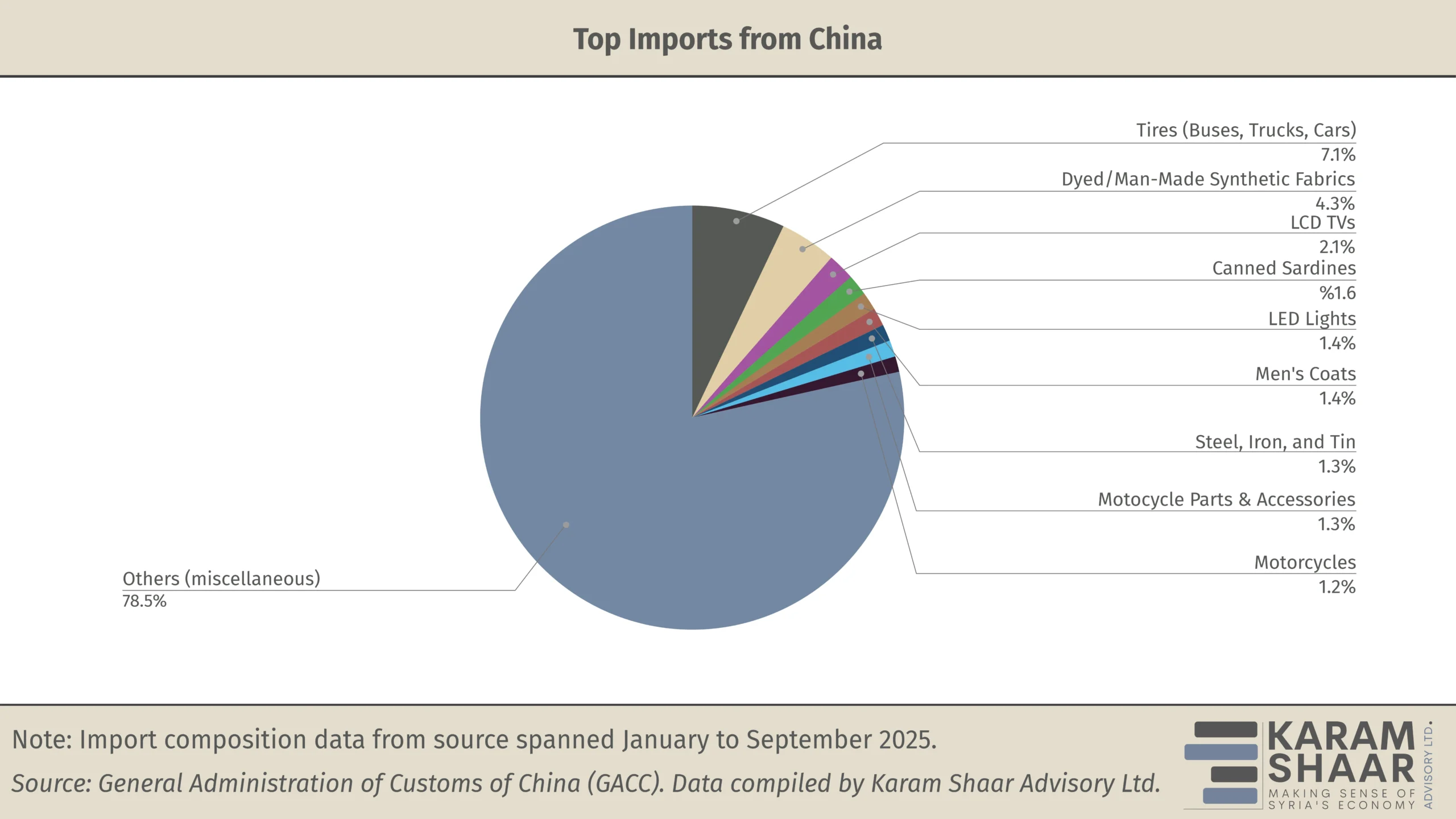

Between January and September 2025, the latest period covered by Chinese customs data, imports were dominated by consumer goods and logistics inputs. By value, the largest categories were rubber tires (~USD 21.1 million), synthetic fabrics (~USD 12.8 million), and LCD TVs (~USD 6.1 million). This pattern points to household and small-business demand rather than reconstruction activity.

Some niche imports, such as photovoltaic equipment (~USD 4.1 million), point to a decentralized private response to Syria’s energy shortages. However, the reported October arrival of 16,000 tons of industrial iron does not yet amount to evidence of sustained or large-scale Chinese involvement.

Asset-Light Investments

In the absence of sovereign lending or Belt and Road Initiative (BRI) infrastructure projects, investment activity in 2025 has been driven more by private firms than by Beijing-backed reconstruction finance. A prime example is the 20-year agreement signed in May 2025 by Fidi Contracting, linked to Chinese tech firm AOJ-Technology, to manage the industrial zones in Hessia and Adra. This reflects an asset-light strategy that prioritizes market entry through management contracts rather than capital-intensive investment.

Official Gazette filings reinforce this pattern. Corporate registrations in 2025, including Xuli ZhongSe LLC (steel) and Zhong Investment LLC (mining and energy), point to growing interest in extractive and industrial sectors. This approach allows Chinese firms to secure positions in strategic nodes without the financial exposure associated with large-scale projects.

At the diplomatic level, the Chinese foreign minister has reportedly welcomed Syria into BRI cooperation, while stressing that Syria must take “effective measures” to prevent terrorist groups from undermining Chinese interests.

Structural Financial and Security Constraints

Although commercial flows rebounded slightly in late 2025, Beijing kept state-directed financial support tightly capped. During the Syrian foreign minister’s November 2025 visit to China, Beijing pledged 380 million yuan (~USD 52 million) in aid. The figure signals diplomatic goodwill but remains negligible relative to Syria’s multibillion-dollar reconstruction requirements and to pledges from the EU, Türkiye, and Gulf states.

Constraints on deeper Chinese involvement are both economic and political. Syria’s weak fiscal standing, obscure sovereign credit rating, and limited ability to guarantee returns—often a prerequisite for state-backed Chinese financing—effectively preclude lending. Public statements by Syrian officials that they will not take on external debt or borrow from the IMF or World Bank further explain why Beijing has not supported large-scale construction projects typically funded by loans.

Security considerations reinforce these limits. The continued presence of foreign fighters, including those incorporated into the new Syrian Army’s 84th Division, places a firm diplomatic ceiling on Beijing–Damascus relations. In November 2025, China was the only UN Security Council member to abstain from the vote to remove Syria’s interim president, Ahmad al-Sharaa, and his interior minister from the terrorist list. Beijing’s explanation cited concerns over the fragile security environment and the difficulty of counterterrorism during the political transition.