Cutting Zeros, Restoring Trust: The Redenomination Debate

- Issue 9

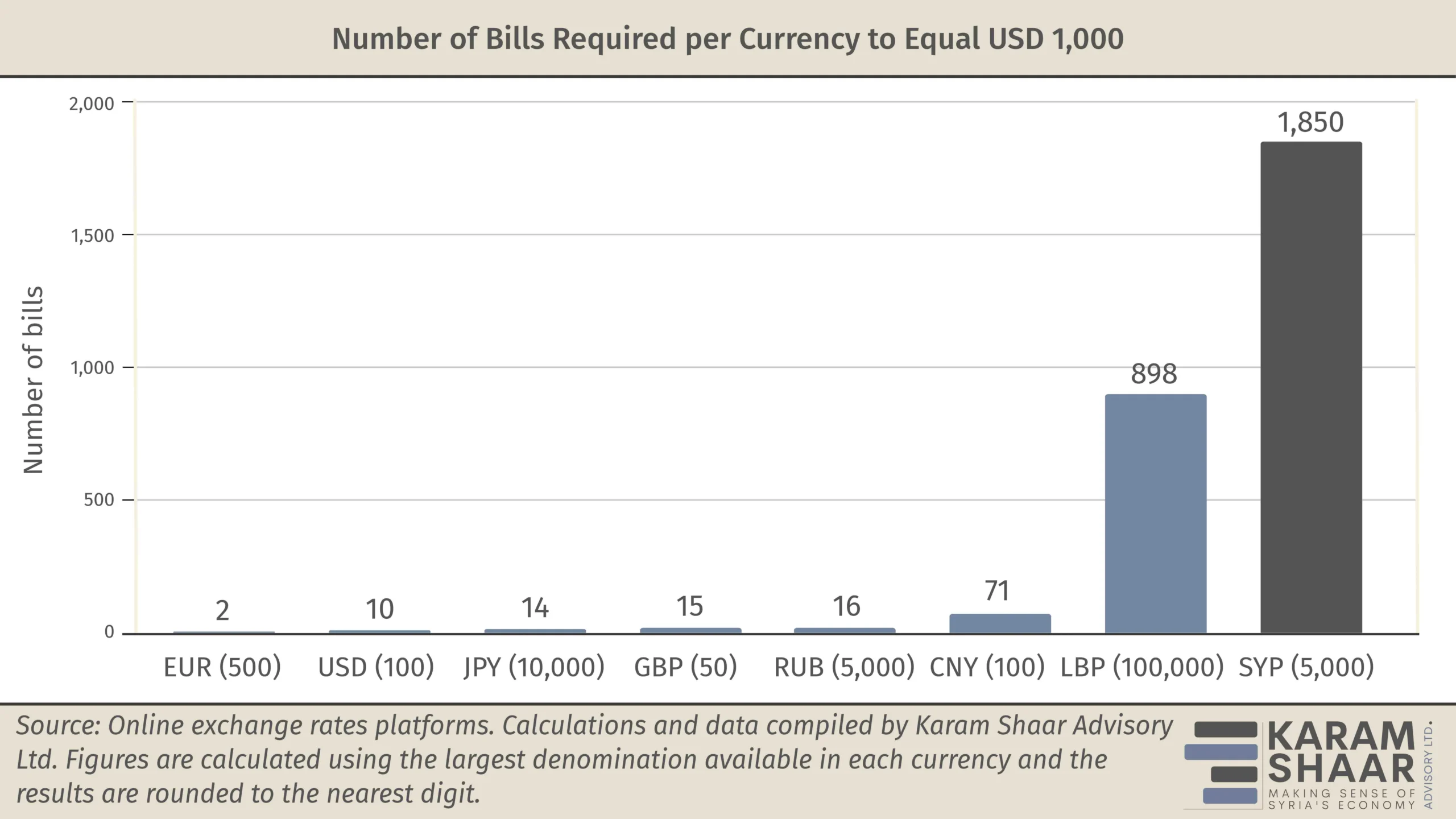

The Syrian pound (SYP) now circulates in denominations as high as SYP 5,000, a note worth barely 50 US cents at the current black market exchange rate. Since 2011, the currency has lost over 99.5% of its value, making everyday transactions increasingly burdensome. The equivalent of USD 1,000 in SYP 5,000 notes weighs two kilograms, compared to just 10 grams in USD 100 bills. This collapse not only disrupts commerce but also strains accounting systems and reinforces public perceptions of continued economic decline.

Redenomination, in principle, is a nominal adjustment that does not affect real purchasing power: what cost SYP 10,000 before would cost SYP 10 after removing three zeros. But its effects extend beyond arithmetic. It improves transactional efficiency by allowing prices to be expressed in smaller, more manageable numbers, shortening ledger entries and easing accounting. New higher-value notes can also reduce cash storage needs and cut transport costs.

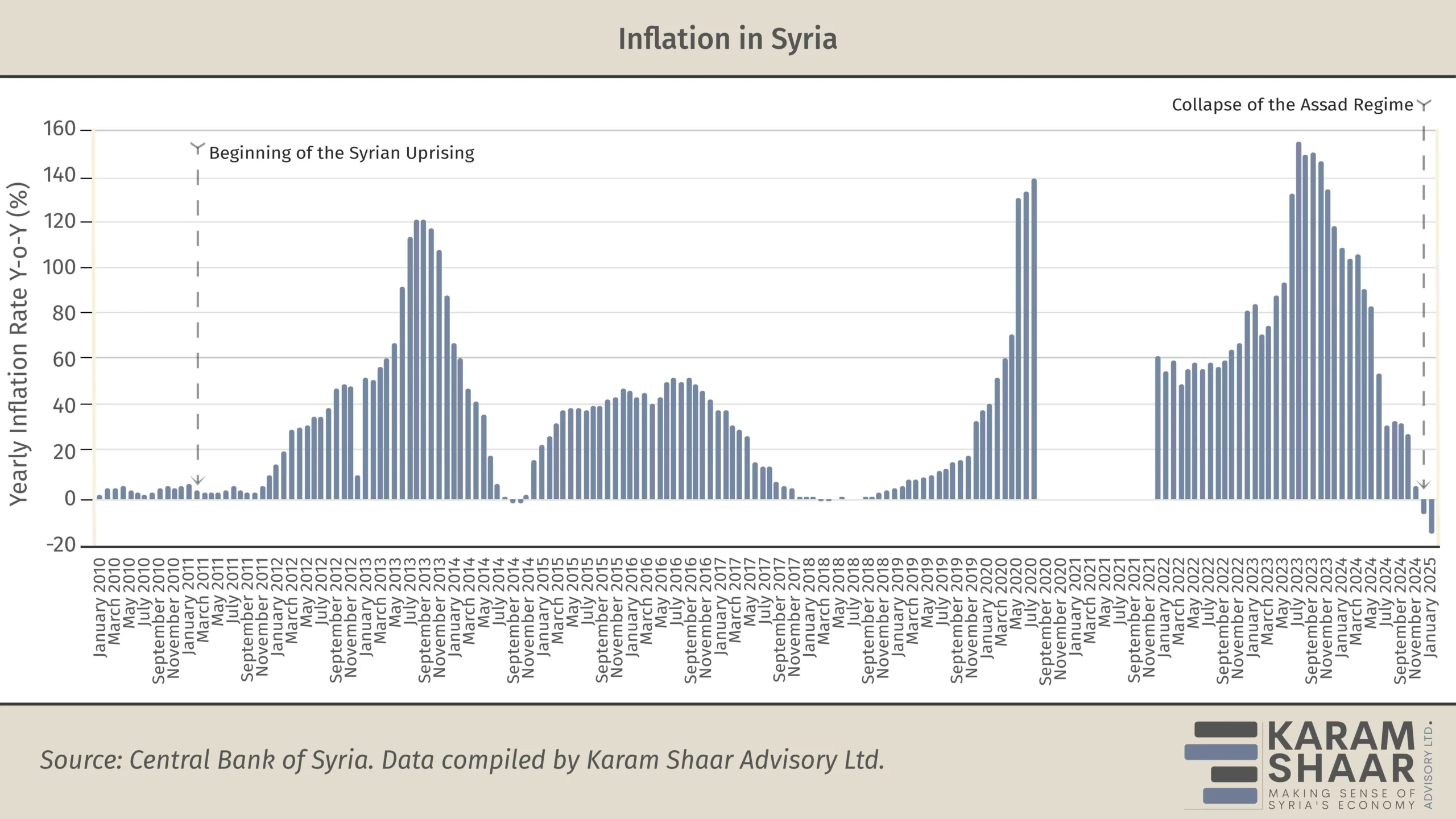

Perhaps more importantly, redenomination carries psychological weight, especially among those who wrongly equate currency strength with economic health. Some experts argue that it could reassure the public that inflation, once rampant during the conflict, is now under control.

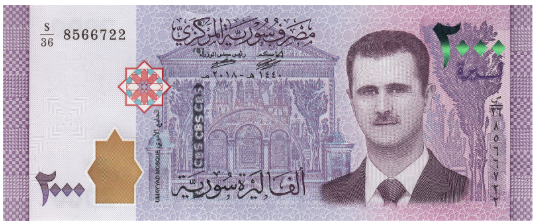

In this context, the psychological aspect may be even more pronounced. The current SYP 2,000 note prominently features the image of former dictator Bashar al-Assad. Redenomination would allow the Central Bank of Syria (CBS) to redesign the currency series, both as a practical step and as a symbolic break with the past. Issuing new banknotes free of Assad’s iconography could help reinforce public confidence in the emerging political and economic order, influencing behavior and potentially encouraging investment.

The SYP 2,000 banknote (top) bears a portrait of Bashar al-Assad. An earlier design of the SYP 1,000 note (bottom), still widely circulated, depicts his father, Hafez al-Assad (1970–2000).

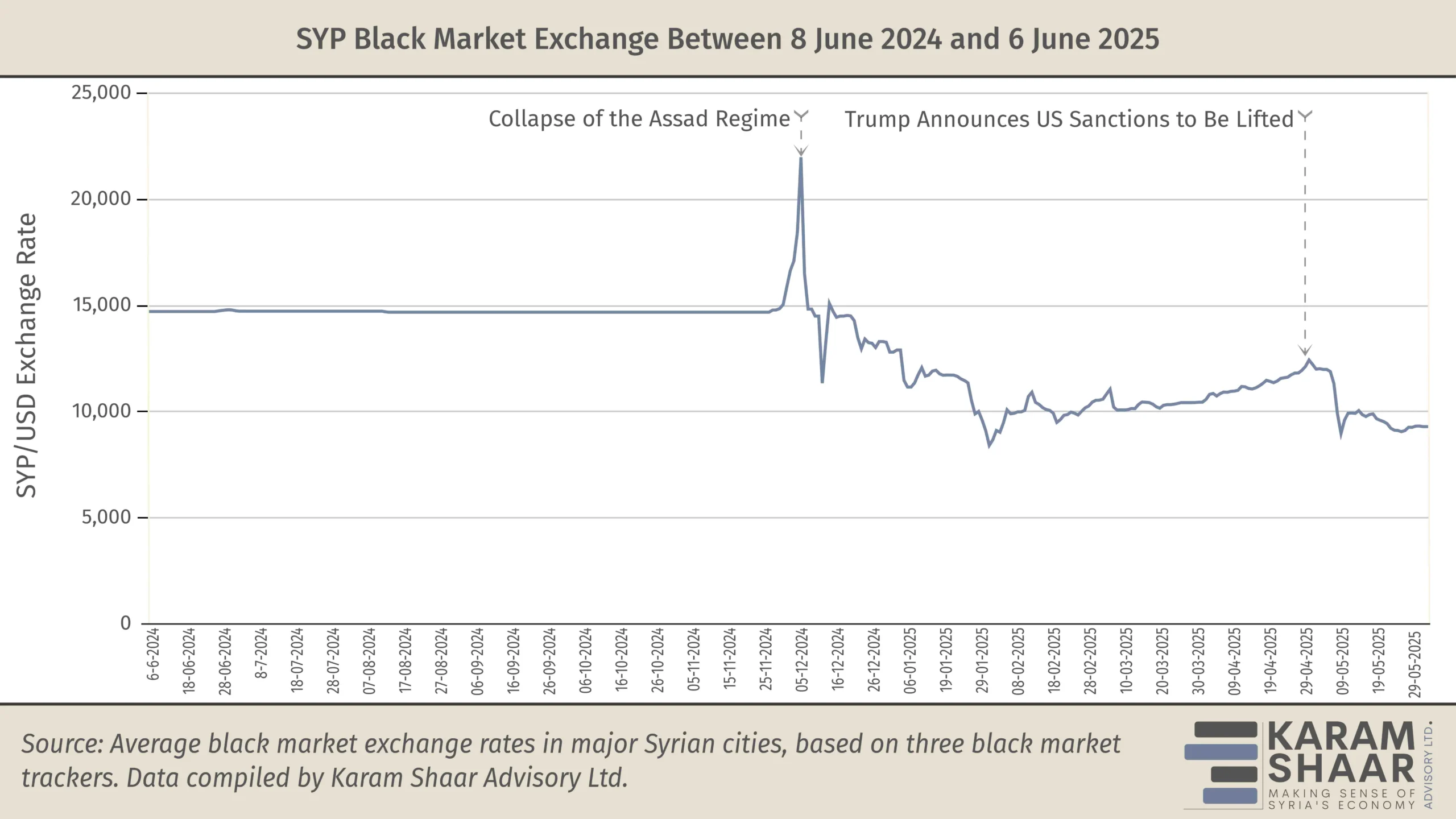

The SYP 2,000 banknote (top) bears a portrait of Bashar al-Assad. An earlier design of the SYP 1,000 note (bottom), still widely circulated, depicts his father, Hafez al-Assad (1970–2000). If implemented carefully, redenomination could also strengthen monetary sovereignty. After the regime’s fall, black market speculation surged with dramatic swings in the exchange rate (see chart below). The standard deviation of the SYP black market rate—a key measure of volatility—jumped from 369.4 over the period from 8 June to 7 December 2024 to 1,518.6 in the six months that followed. This fourfold increase makes business planning more difficult and threatens recovery by undermining investor confidence.

In a largely cash-based economy, large volumes of old banknotes held outside the formal system pose a serious challenge to monetary control. Redenomination could offer the CBS a chance to reset the monetary base. By declaring only the new notes as legal tender, monetary authorities could reassert control over money supply, weaken offshore hoarding, and improve tools for combating money laundering and terror financing.

Still, redenomination alone won’t restore confidence in the SYP if the economy remains heavily dollarized. Since the regime’s collapse, US dollar use has expanded in both government-held areas and the northeast, particularly following what appears to be decriminalization of foreign currency use in former regime zones. In the northwest, the Turkish lira has long been the dominant medium of exchange. This widespread currency substitution presents a structural challenge to monetary reform. Without complementary measures, such as legal tender mandates, SYP-based pricing, or incentives to use local currency, the new pound may fail to take hold.

Getting Into the Process

Redenomination is not merely a technical exercise. It involves several key phases: stabilizing macroeconomic conditions, preparing a rollout plan, printing the new currency, and finally introducing it into circulation.

In weak regulatory environments like Syria’s, merchants may exploit the transition by rounding up prices or inventing unofficial exchange rates between the old and new currency. To counter this, authorities could implement a dedicated redenomination policy, such as Türkiye’s Currency Law of 2005, that includes price-rounding caps, penalties for speculative pricing, and consumer protection units to monitor compliance in real time.

Equally important is a strong public communication strategy. In Türkiye, the government and central bank coordinated a nationwide campaign to educate the public, build trust, and ensure a smooth transition to the New Turkish Lira.

International experience shows that timing is key. Countries that implemented redenomination after improving economic stabilization—such as Türkiye (2005), Poland (1990), and Ghana (2007)—reaped lasting benefits. In contrast, those that acted during crises—Argentina, Brazil, Zimbabwe, and Venezuela—saw their new currencies quickly lose value, undermining public confidence and replicating the very conditions redenomination was meant to fix.

Syria, however, may be entering a more favorable moment. Many of the drivers behind the SYP’s collapse, including conflict, sanctions, capital flight, and corruption, have either eased or disappeared. With Bashar al-Assad ousted, sanctions lifting, and a reform-minded government in place, the country has a rare opportunity. Inflation is already beginning to slow, as noted in a previous Syria in Figures issue.

That said, the SYP is not yet ready for redenomination. As long as the government continues financing deficits by printing money without boosting real economic output, inflationary pressure will return.

Given limited domestic capacity, authorities could benefit significantly from international support, particularly in capacity building, financial aid, and policy guidance from institutions such as the International Monetary Fund. Countries that have undergone successful redenomination, including Türkiye, could also offer valuable technical expertise. Finally, as part of a broader reform support package, donors could consider covering the cost of printing the new currency.