New Banknotes for a New Syria: Rebuilding Trust and Restoring Faith in the Pound

- Issue 10

In the previous issue of Syria in Figures, we discussed redenomination as a potential economic policy tool that authorities could adopt to facilitate transactions, rebuild trust, and enhance monetary sovereignty. However, redenomination is a highly technical process. In the short to medium term, it would likely be costly and complex, requiring legislative changes, comprehensive recalibration of accounting systems, and a range of logistical steps.

As an alternative, issuing a new series of Syrian pound (SYP) notes could achieve some of the same objectives at far lower financial and operational cost, since it would not require immediate currency replacement or major changes to accounting systems. In fact, this step appears long overdue: adjusted for devaluation against the US dollar, the SYP 10,000 and SYP 20,000 notes should have been introduced in 2020 and 2023, respectively.

The Need for A New Series

The psychological impact of introducing a new series would be significant. As we noted in our previous issue, removing the portraits of Bashar and Hafez al-Assad from banknotes would send a strong political message of transition. Other post-authoritarian or post-conflict states—including Libya after Gaddafi, Iraq after Saddam Hussein, and South Africa after apartheid—took similar steps. In each case, currency redesign without redenomination helped signal the beginning of a new national identity.

Politically, a new series could serve as a soft reset, marking the normalization of macroeconomic conditions and the launch of broader reforms. A reset through new, higher-denomination notes, rather than a full overhaul, could also help restore acceptance of the SYP in areas where it had been abandoned. This would support monetary unification across the country.

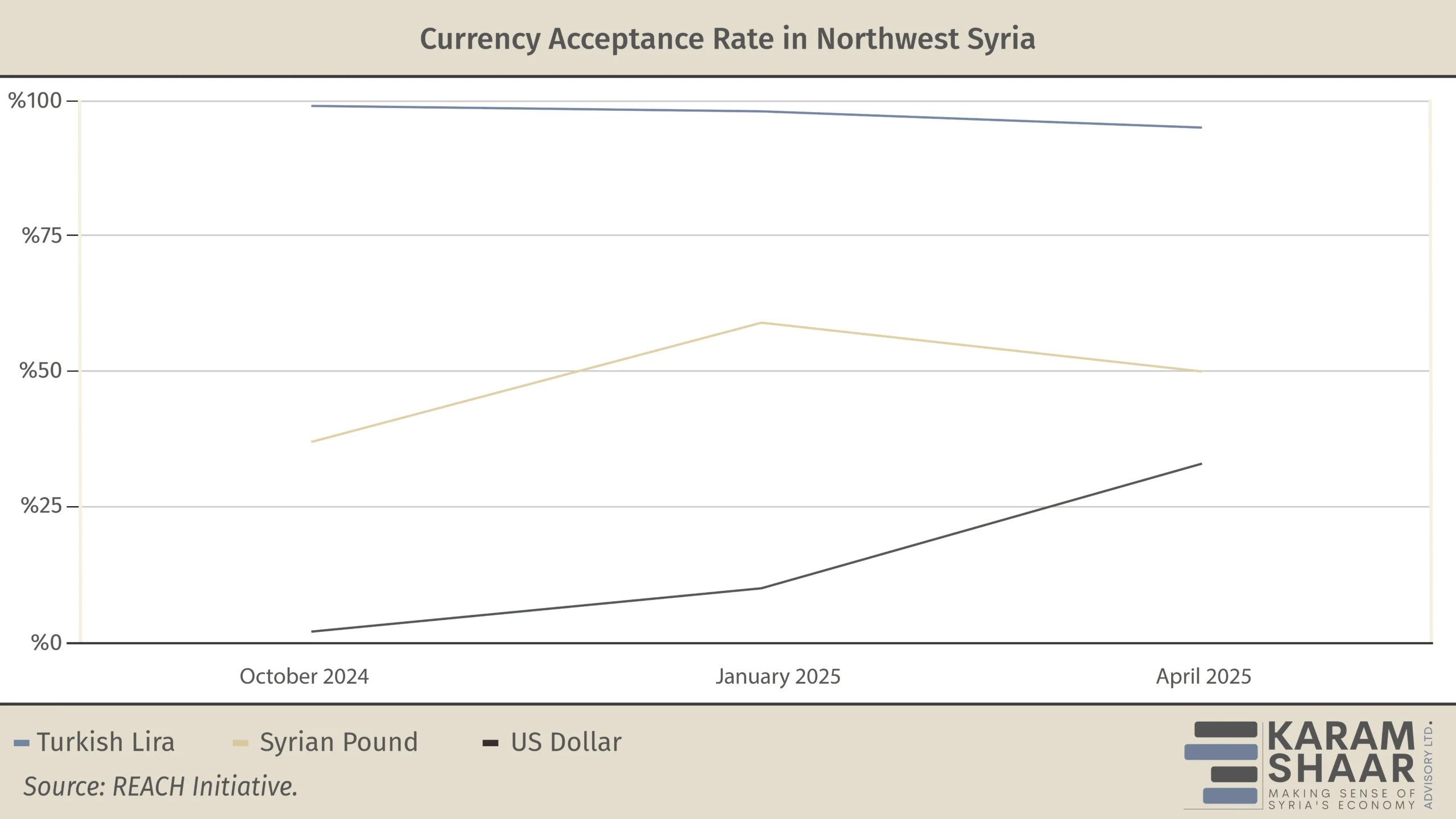

For years, northwest Syria has relied on the Turkish lira. While the SYP’s use has increased in these areas since the Assad regime’s collapse (see chart below), monetary fragmentation remains a major challenge—especially in a region home to roughly a quarter of the country’s population. This fragmentation limits the Central Bank of Syria’s (CBS) ability to implement monetary policy (see Lebanon’s struggle with dollarization and monetary policy). Higher-denomination notes would also ease storage and transport burdens, making the SYP more practical for everyday use and more attractive for re-adoption.

After a decade of inflation, the highest current denomination (SYP 5,000, worth about USD 0.48) is no longer sufficient. Introducing SYP 10,000, 20,000, or even 50,000 notes would simplify cash transactions, reduce printing and handling costs, and improve efficiency in a cash-based economy.

Table: Most Common Banknotes in Circulation | ||||

|---|---|---|---|---|

Banknote | Face Value (SYP) | USD Value in March 2011 | USD Value in | Model (Front face) |

“New” | 500 | 10.6 | 0.048 |  |

“New” | 1,000 | 21.2 | 0.096 |  |

2,000 Note | 2,000 | 42.4 | 0.192 |  |

5,000 Note | 5,000 | 106.4 | 0.481 |  |

Source: Exchange rate as on Karam Shaar Advisory Ltd. Black Market Tracker (24 June 2025). Banknotes weighted and data compiled by Karam Shaar Advisory. | ||||

More importantly, a new series would help the CBS to reassert control over the money supply. As noted in our previous issue, speculation surged after the regime’s collapse. Whether these fluctuations reflect market forces or speculative activity remains unclear. Withdrawing old notes would give the CBS tools to monitor large cash holdings, demand justification for high-value exchanges, and block funds lacking a verifiable origin.

Examples from Trinidad and Tobago and Kenya (2019) show how such efforts can succeed. Those unable to justify the source of their funds—such as smugglers or speculators—may be excluded from conversion or rejected by banks. But unless strict enforcement mechanisms are in place, the outcome may mirror India’s failed 2016 effort.

What Stands in the Way

There are clear limitations to issuing a new series of banknotes; most notably, the financial burden of implementation.

According to official data accessed in mid-2024 by Karam Shaar Advisory Ltd., cash in circulation—the physical money requiring replacement—stood at SYP 16.08 trillion in 2022. Printing such a volume of currency would likely cost hundreds of millions of dollars. For reference, printing USD banknotes ranges from 5.4 to 19.4 cents (1 cent is 1/100 of USD 1) per note depending on denomination. However, introducing higher-denomination bills such as SYP 10,000, 20,000, or even 50,000 would partially replace smaller notes, significantly reducing the total number of bills needed and therefore the overall cost. In effect, higher-denomination notes could be 5 to 25 times more cost-effective to produce than their lower-value counterparts.

Still, capitalizing on this opportunity will likely require external support. As part of a broader economic aid package, donor governments could help finance the technical costs of printing and distributing a new series.

The risks extend beyond cost. In a low-trust, post-conflict environment, unclear communication could trigger public panic, spark devaluation rumors, or fuel hoarding and speculative runs. The CBS has already faced waves of rumor-driven volatility amid a highly reactive black market. Speculators could exploit gaps between old and new notes or parallel markets, and continued circulation of old notes could weaken the reform’s credibility. Without a clear and well-managed rollout, confusion and cash shortages are likely—similar to Nigeria’s experience in 2022.

Ultimately, success will hinge on competent and transparent implementation. In an economy where informal activity dominates and many rely on undocumented cash savings, clearly defined procedures and legal safeguards will be essential. Strong public messaging, consistent enforcement, and protections against arbitrary treatment will be critical to building public confidence.