The Syrian Pound: Policy Limits and Market Pressures

- Issue 16

In the previous issue of Syria in Figures, analysis of the Syrian pound’s exchange-rate movements in 2025 showed that sharp swings were driven less by economic fundamentals than by market reactions to political and economic announcements. The currency’s broader trend, however, continued to point to gradual depreciation, reflecting a structural shortage of foreign currency.

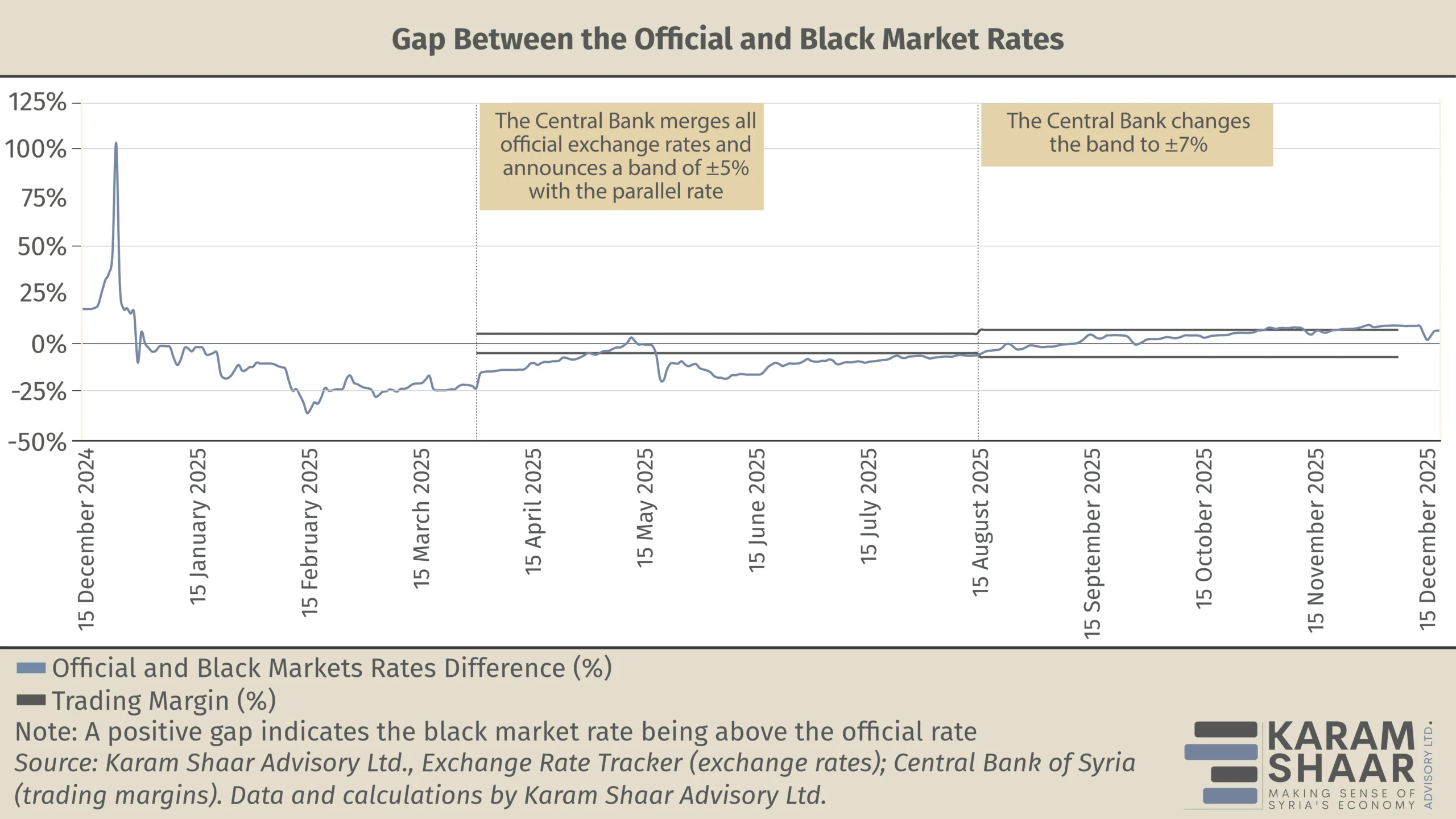

The existence of two de facto exchange rates, official and black-market, continues to distort economic activity that must use both across different transactions. At its peak on 5 February 2025, the gap between the two exceeded 35 percent, complicating accounting and financial planning, weakening investor confidence, and delaying long-term investment decisions.

Monetary Policy Actions

Following post-war volatility, the Central Bank of Syria made its first formal attempt to manage the exchange rate. On 23 March 2025, it announced the unification of its exchange-rate bulletins and mandated a ±5 percent pricing band for licensed banks and exchange companies. The aim was to narrow the gap between the official and black-market rates while allowing limited flexibility for formal market participants.

Although the measure appeared technically straightforward, its limits quickly became clear. Between 23 March and 5 August, the black-market rate remained outside the designated band on 120 of 136 trading days, nearly 88 percent of the period, based on our analysis of Syrian pound exchange-rate data.

On 6 August, the band was expanded to ±7 percent, implicitly acknowledging the earlier framework’s shortcomings. The exchange rate remained within the new corridor until 27 October, when it first breached the limit. From 27 October to 14 December, the gap again exceeded the ±7 percent threshold on 34 of 54 days. While the wider band initially restrained movements, it ultimately failed to anchor market expectations, eroding the credibility of the Central Bank’s framework.

Despite the formal unification of exchange-rate bulletins, public petroleum products remain priced closer to the black-market rate, indicating weak coordination across state institutions. In parallel, recent coordination meetings between the Central Bank and UN agencies have produced a new proposal to use a blended conversion rate between the official and black-market rates rather than the official rate alone, further weakening the credibility of the declared framework.

The Central Bank’s June 2025 adoption of a managed float highlighted the same disconnect. A managed floating regime requires usable foreign-exchange reserves to allow intervention during periods of volatility. Syria lacks such reserves, and no open-market operations to buy or sell foreign currency have been announced.

Outlook

In 2025, the Central Bank took three major steps to manage the exchange rate: unifying official rates, imposing pricing bands, and adopting a managed float. In practice, these measures had little effect, raising doubts about their feasibility and credibility. Restoring confidence will require more limited but implementable steps rather than headline policies that exceed the Bank’s capacity.