US-Syria Trade Between Sanctions, Overcompliance, and Tariffs

- Issue 16

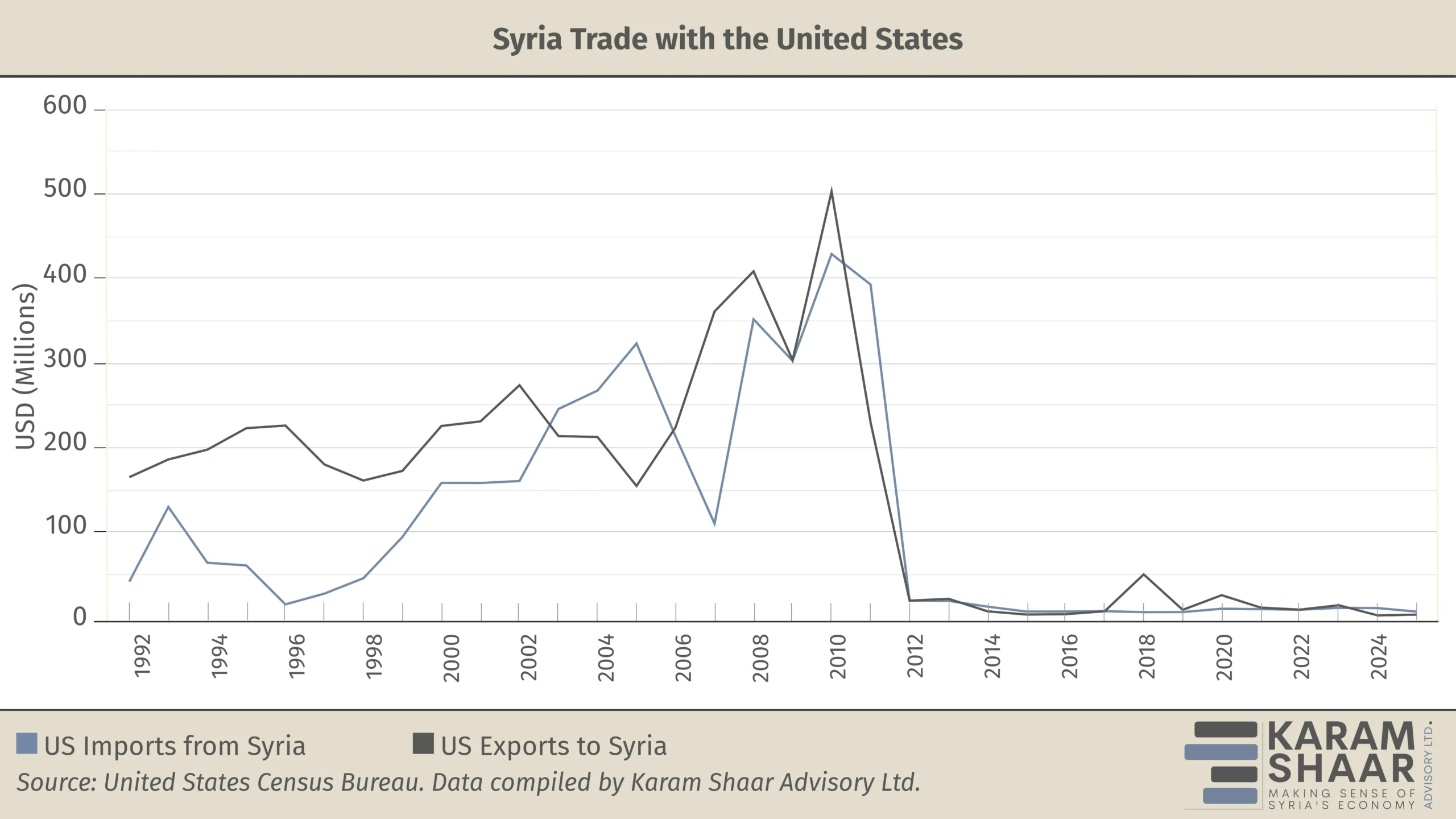

The repeal of the Caesar Syria Civilian Protection Act in late 2025 marked a historic shift in US–Syria relations but did not lead to a recovery in bilateral trade. Although most sanctions and restrictions have been lifted, US–Syria commerce remains constrained by ongoing restrictions, punitive tariffs, financial de-risking, high compliance costs, and other non-tariff barriers.

At the core of these barriers are three long-standing sanctions regimes.

First, Syria remains designated as a State Sponsor of Terrorism (SST). This status prevents Syria from receiving Normal Trade Relations, the US legal designation that allows low-tariff trade with a foreign country. When imposed in 1979, the SST designation sharply restricted US foreign assistance and constrained the flow of US goods into Syria, particularly dual-use items.

Second is the Syria Accountability and Lebanese Sovereignty Restoration Act (SAA) of 2003. Sanctions under this law prohibited US investments in Syria, barred Syrian aircraft from US airspace, and froze the then-Assad regime’s assets. Most importantly for current trade relations, the Act also banned US exports of defense and dual-use items to Syria. Some commercial restrictions were eased on 2 September 2025, allowing limited exports of civilian goods, including consumer communications devices and certain items related to civil aviation, but strict licensing requirements remain in place for most Commerce Control List items.

The third remaining barrier is the Chemical and Biological Weapons Control and Warfare Elimination Act of 1991. Although Executive Order (EO) 14312 of June 2025 waived its mandatory application, the statute remains in force and allows the US to reimpose penalties for non-proliferation violations. This continued legal exposure discourages long-term industrial contracts involving dual-use chemical inputs.

Even where trade is legally authorized, compliance risks remain substantial. Under the Treasury Department’s Promoting Accountability for Assad and Regional Stabilization Sanctions program, targeted sanctions continue to apply to Bashar al-Assad and his associates, human rights abusers, captagon traffickers, individuals linked to Syria’s past proliferation activities, ISIS and Al-Qaeda affiliates, and Iran and its proxies.

A more systemic challenge stems from EO 13224 of 2001, which maintains the terrorist designation on Hayat Tahrir al-Sham (HTS). The group was founded by Syria’s current president Ahmad al-Sharaa and led the campaign that brought down the Assad regime in late 2024. Under the order, the US government is authorized to block the assets of any individual or entity that provides support, services, or assistance to designated terrorist organizations. Although HTS has been formally disbanded, its fighters now form the core of Syria’s security apparatus, and many of its former members hold government posts and exercise economic influence. This creates acute contagion risk, where sanctioned individuals embedded within otherwise legitimate state institutions may expose entire organizations to enforcement action when foreign partners cannot reliably separate designated actors from lawful operations.

Furthermore, recently increased tariffs stifle Syrian exports to the US market. Under EO 14257, which modified “reciprocal tariff rates,” Syrian goods are subject to a reciprocal tariff of 41 percent in addition to any product-specific duties. By contrast, exporters in neighboring Egypt and Jordan benefit from the 1996 Qualifying Industrial Zones (QIZ) protocol, which provides duty-free access to the US market. Even before shipping, insurance, or financing costs are considered, a Syrian product therefore enters the US market at a price that is at least 41 percent higher than that of an equivalent good from a regional competitor. This disadvantage is further amplified by non-tariff barriers such as high-risk insurance premiums.

Banking Overcompliance Persists

Beyond tariffs, years of sanctions have created a culture of overcompliance and de-risking among global banks and international insurers. Perceived legal and reputational risks, along with the fear of future penalties or regulatory scrutiny, have long outweighed the commercial benefits of engagement with Syria.

This caution is reinforced by the inability of Syrian banks and monetary authorities in Damascus to meet international standards on money laundering and terrorist financing, as reflected in Syria’s continued grey-listing by the Financial Action Task Force. As a result, due diligence costs and compliance risks associated with Syria-linked transactions often exceed potential revenue.

Even where transactions are formally authorized, many international banks remain unwilling to process them. The cumulative effect is the continued erosion of Syria’s correspondent banking relationships, which either blocks trade entirely or pushes it into informal and less transparent channels.

Outlook

The persistence of trade restrictions, the imposition of high tariffs, and ongoing banking overcompliance show that the recent repeal of some US sanctions removed only one, though significant, barrier to normalization.

The future of US–Syria economic relations now depends on whether remaining legal, financial, and institutional obstacles can be addressed. That outcome will require sustained engagement and support from state institutions in both countries.