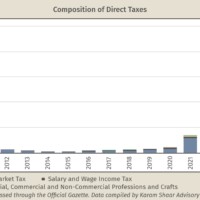

Syria’s direct tax system is no longer fit for purpose; urgent reforms are needed. Since 2010, direct taxes have fallen from 21% to just 11% of government revenue. And because of the SYP’s devaluation over that time, direct tax income in dollar terms has dropped from USD 4.8 billion to just USD 400 million.

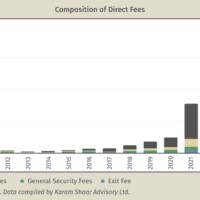

Why? A shrinking tax base, rising evasion, and a heavy shift toward regressive fees. In 2024, 99% of direct tax revenue came from income and salary taxes, while capital and wealth-based taxes have nearly disappeared, further exacerbating inequality. Fees have surged, especially on passports and permits. These are easier to enforce but disproportionately burden the poor.

Can Syria’s interim authorities improve the system’s fairness? Will ongoing reforms be sufficient to prevent inequality from fueling future instability?