The Revival of Syria’s Gas Pipeline Network

- Issue 14

Oil and gas pipelines form the backbone of Syria’s energy sector, linking upstream production fields with downstream refining, distribution, and export. Before the conflict, the government pursued several projects to strengthen the network and reinforce Syria’s role as a regional transit hub, but ensuing insecurity and widespread infrastructure damage brought that vision to a halt. In the post-Assad era, the new authorities have begun rehabilitating the system, recognizing that a functioning network is vital for economic recovery and reintegration into regional trade.

This article focuses on the gas pipeline network; a follow-up piece in the coming issues will cover the planned regional projects, and a subsequent article will examine the oil pipelines.

The Gas Pipeline Map

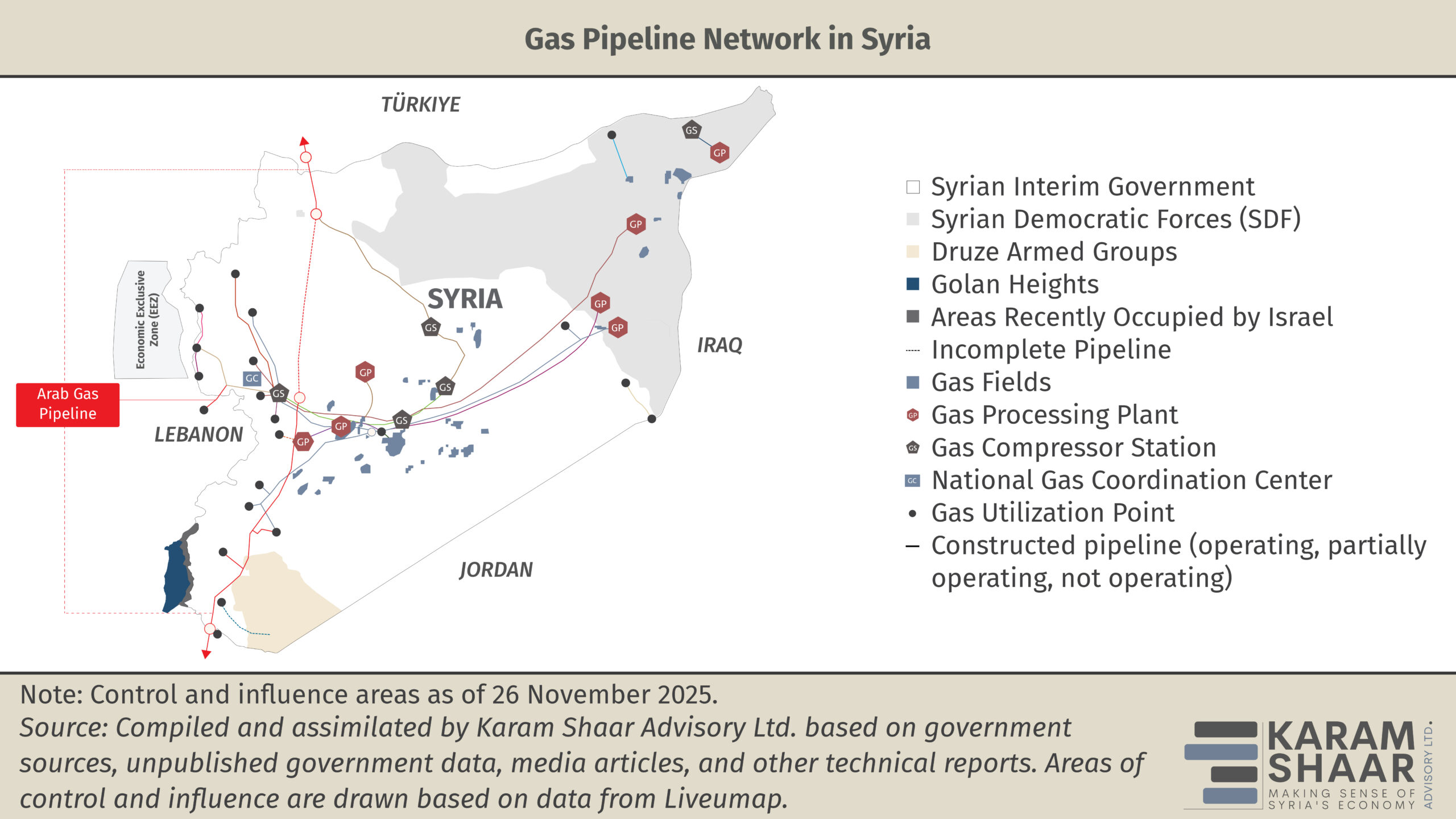

Syria has an extensive domestic natural gas pipeline network of over 2,500 km of transmission lines across the country that deliver processed, ready-to-use gas to power plants and other domestic needs, such as industry and households.

Complementing this system are over 2,200 km of gathering pipelines that link production wells to a network of gathering and pressure stations, all managed through the National Gas Coordination Center. The network is supported by more than six gas processing plants. Together, these components form an integrated framework for gas production, processing, and distribution across the country. It is also worth noting that Syria developed well-functioning oil and gas infrastructure with international support; overall infrastructure quality was near the world median in 2011, rated 3.3 out of 7 by the World Economic Forum.

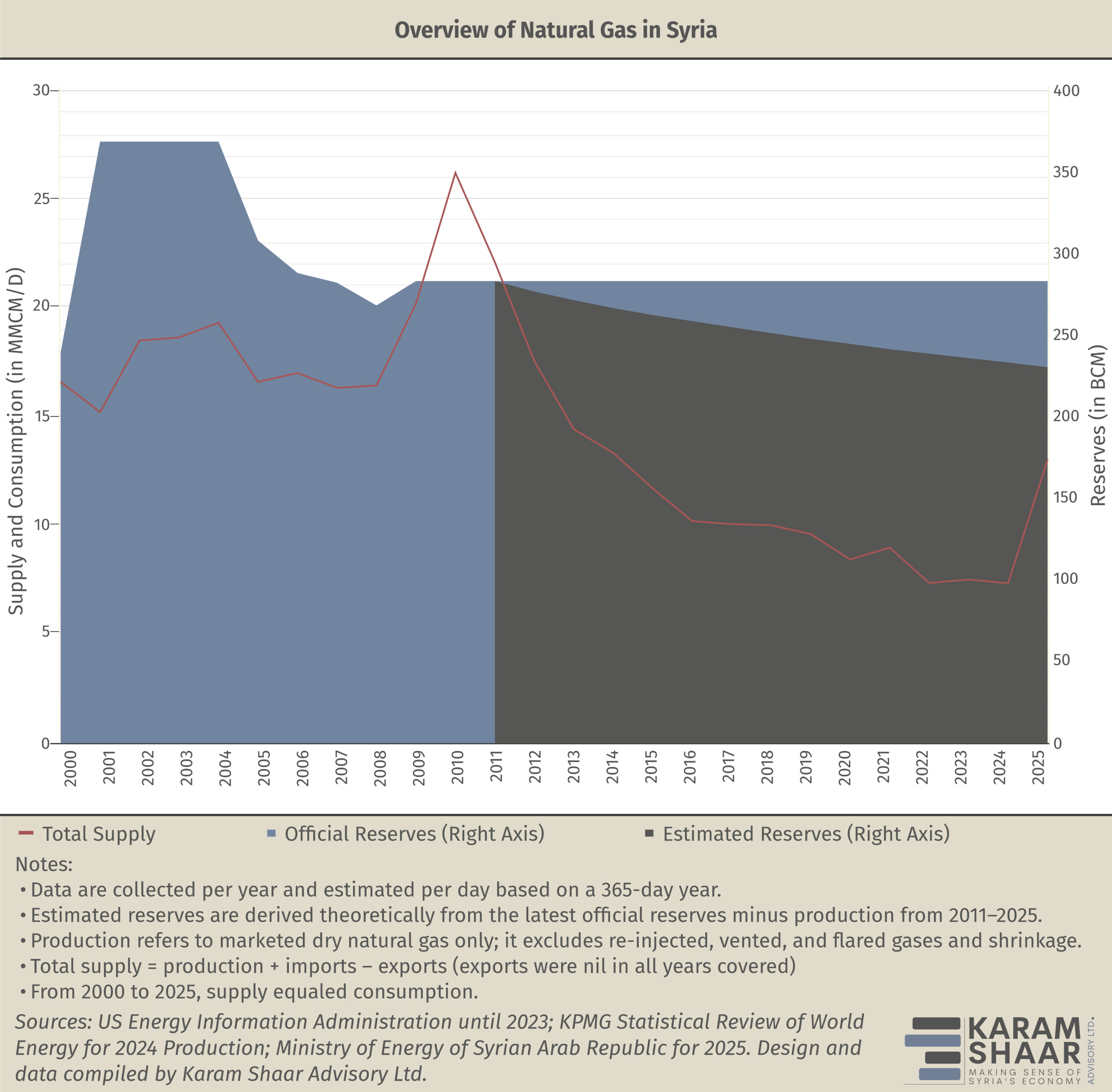

The bulk of Syria’s natural gas reserves lie in the central and eastern regions. The last official assessment in 2011 put reserves at 285 billion cubic meters (BCM), but we estimate that production since then has reduced remaining onshore proven reserves to about 231 BCM. Over the same period, offshore potential was estimated at roughly 170 BCM, while the former authorities reported two minor onshore discoveries—Deir Atiyah in 2019, yielding only 500 cubic meters, and Zamlat al-Mohr in 2022, for which no reserve figures were released.

Before the conflict intensified in 2012, Syria’s gross natural gas production reached its historical peak at approximately 30 million cubic meters per day (MMCM/D) in 2011. At that time, about 9% of the gross production was flared, vented, or re-injected to maintain pressure in oil wells. By 2024, production had fallen sharply to around 7.4 MMCM/D, while fields under the control of the Syrian Democratic Forces (SDF) in northeast Syria produced roughly an additional 1 MMCM/D. Figures from 2023 indicate that more than half the total gas supply was used for electricity generation.

Syria’s shift to gas-fired electricity generation after 2005 pushed demand beyond domestic supply, making the country a net gas importer by 2008. The Arab Gas Pipeline (AGP) enabled these imports, supplying Egyptian gas until 2011, when repeated attacks in Sinai and falling Egyptian output halted the flow. Over its four years of operation, Damascus imported an average of 1.44 MMCM/D.

The Arab Gas Pipeline in Syria

The AGP is one of the region’s major gas infrastructure projects, running roughly 1,330 km through Egypt, Jordan, Syria, and Lebanon, with long-standing ambitions to extend to Türkiye and European markets, especially after Iraq expressed interest in connecting and supplementing the supply. It was built in four phases, at a total cost of approximately USD 1.2 billion. The Syrian section, slightly more than 600 km, extends from Jaber to Homs and then to Aleppo before entering Türkiye, with a branch to Lebanon. All sections within Syrian territory have been completed except for the 240 km stretch between Homs and Aleppo. The Aleppo–Kilis segment—initially expected to be completed in early 2011, was ultimately finished in May 2025. Gas flowing through the AGP marked the start of a period in which Syria sought to balance domestic production with imports and potential transit revenues. After years of disruption from war, sabotage, and political instability, the government carried out maintenance to restore the network. On 11 September 2021, former Minister of Oil and Mineral Resources Bassam Tohme announced that the Syrian section of the AGP had been fully repaired from Jordan to Homs and was ready to transport Egyptian gas to Lebanon.

The AGP now connects Syria to the wider regional network, though current flows run north-to-south, rather than from Egypt. In August 2025, Türkiye began supplying Azeri gas to Syria via the newly completed 93-km Kilis-Aleppo segment, which links to Türkiye’s South Natural Gas Pipeline and then to the Trans-Anatolian Natural Gas Pipeline (TANAP). TANAP currently sends 3.4 MMCM/D, with plans to increase to 6 MMCM/D. In late August, the Syrian Ministry of Energy signed an additional supply agreement with the Turkish company Nakkaş Holding to deliver 1.6 MMCM/D as part of Syria’s efforts to meet previously agreed volumes with Azerbaijan’s SOCAR and Türkiye’s BOTAŞ. Qatar is financing these gas exports, intended to operate the Aleppo, Tishreen, and Jandar power plants and generate 750–900 MWh—equivalent to an additional four to six hours of electricity, according to the Syrian Gas Company.

A separate arrangement revived the AGP’s southern section in March 2025, when Qatar financed LNG imports through Jordan’s Aqaba terminal to supply the Deir Ali power plant for 50 days at an average of approximately 2 MMCM/D based on our collected data. LNG tankers arrived at Aqaba, where the gas was regasified and transported through the AGP to the Deir Ali subsection of the pipeline in southern Damascus, supporting the generation of roughly 400 MWh of electricity per day at the Deir Ali power plant. Jordanian Energy Minister Saleh al-Kharabsheh announced that the initiative was fully funded by the Qatar Fund for Development. The scheme ended when the grant—estimated at USD 63.75 million—expired, after which Qatar shifted support to the Kilis–Aleppo route.

The revival of Syria’s gas pipeline network marks a critical step toward restoring the country’s energy system and narrowing its supply gap. Renewed connectivity through the AGP and new import deals signals a gradual return to regional cooperation, essential for stabilizing electricity and supporting industrial recovery. Long-term success, however, will depend on sustained investment, securing key routes, coordinating with actors such as the SDF, and mitigating ISIS-related risks.