Mapping MoUs in Syria: Shifting Investment Agendas

- Issue 14

After more than a decade of isolation, Syria’s investment landscape is being reconfigured. Dozens of new Memoranda of Understanding (MoUs)—many driven by Gulf and Turkish actors—signal an emerging realignment. Yet this shift should not be overstated: most commitments remain MoUs, with very few progressing toward implementation.

Building on our earlier analysis of MoU values, ownership structures, and implementation risks, this article turns to the geopolitical dimensions of this new investment wave. It compares pre- and post-Assad models of foreign engagement to show not only who is investing, but how—and what this reveals about Syria’s evolving economic landscape.

Mapping New Investment: A Diverse Geographical Distribution

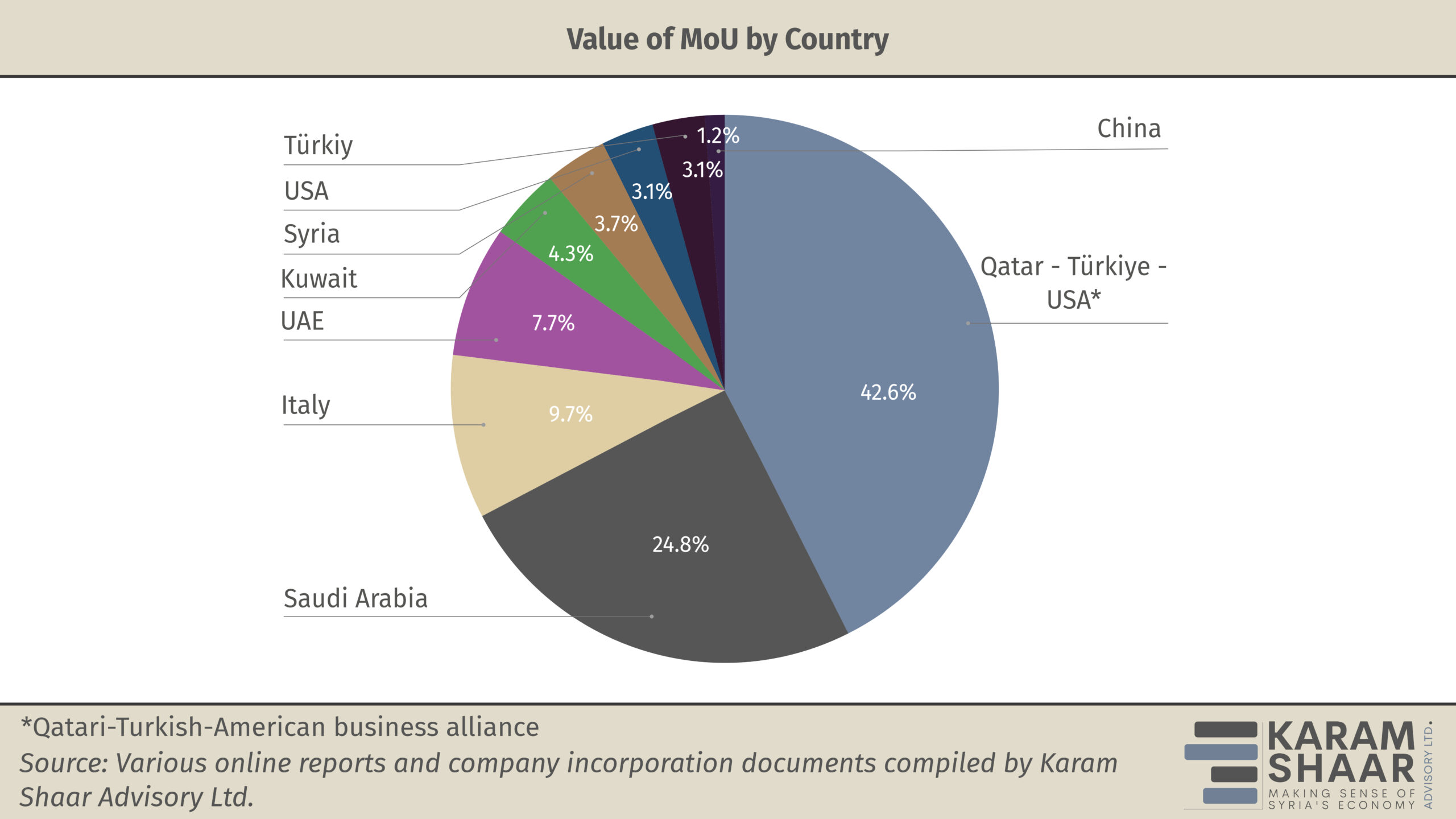

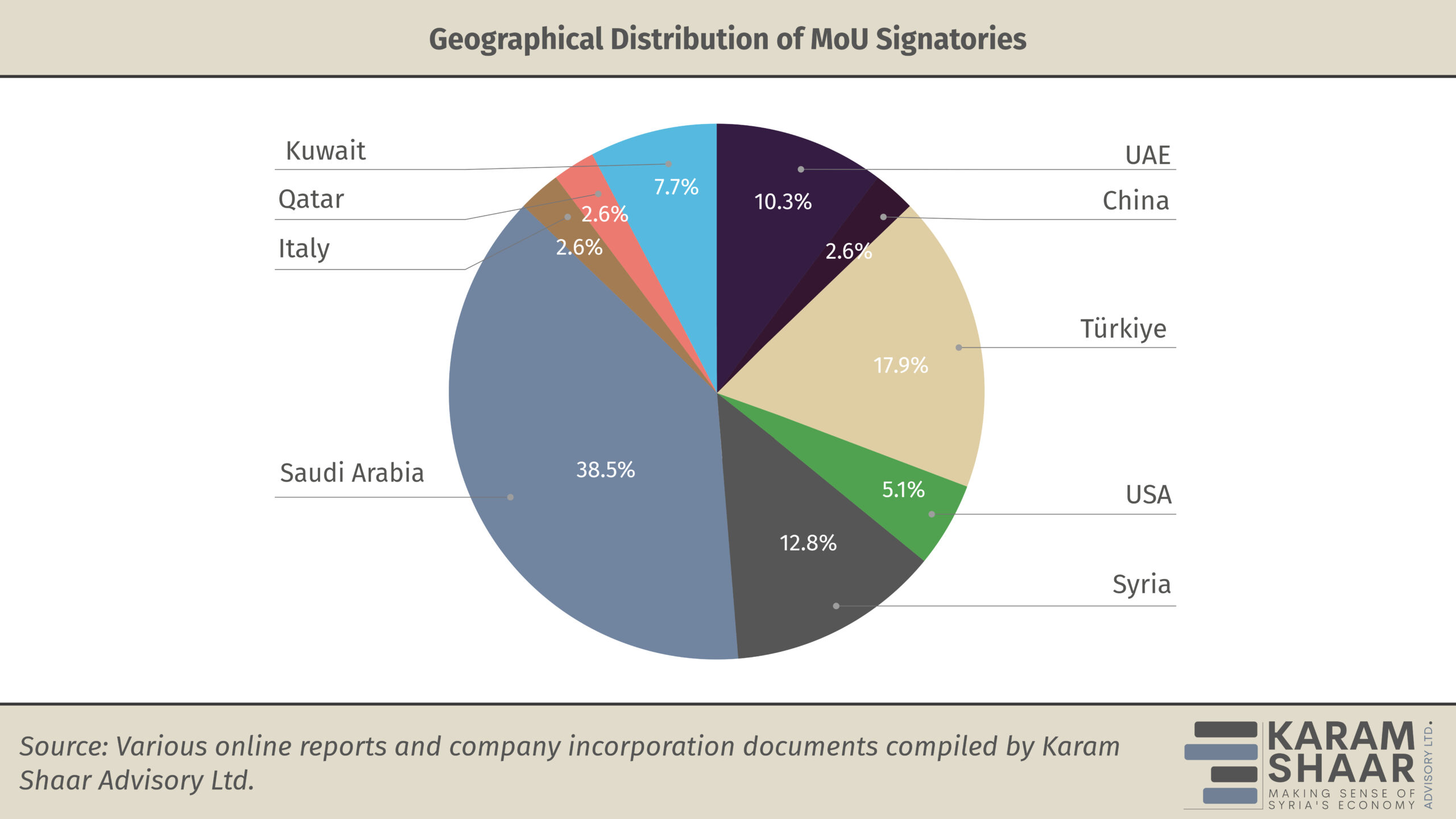

Based on our review of 40 MoUs, the disclosed portions of these agreements amount to USD 25.9 billion—slightly below the USD 28 billion figure announced by Syrian President Ahmed al-Sharaa during the Future Investment Initiative in Riyadh, a discrepancy expected given the absence of published values for several MoUs. The geographical distribution of these agreements shows how regional influence in Syria is being reshaped. Gulf actors now dominate the landscape: Saudi Arabia leads in the number of MoUs signed and ranks second in value, with Saudi firms signing USD 6.4 billion in MoUs during the Syrian–Saudi Investment Forum. The UAE follows with four companies, though only one disclosed its value—the USD 2 billion Damascus Metro project with Al-Wataniya Company. Kuwait comes next with three firms, two of which announced a combined value of USD 1.1 billion, while the third, the ‘Boulevard Homes’ project, disclosed no figure.

Qatar’s engagement takes a different form, driven by a Qatar–Turkish–US consortium led by UCC Holding, which signed two MoUs worth USD 11 billion—about 43 percent of all announced investment this year. The consortium includes Power International Holding, a US-linked firm reportedly tied to the same Qatari corporate network, indicating a financial–logistical structure rather than a broad multinational partnership. Another US-linked company, Classera (EdTech), signed strategic agreements in August 2025 with Syria’s Ministries of Communications, Education, and Health.

Domestically, several Syrian companies have also signed MoUs, but opaque ownership structures and weak governance raise questions about whether many of these deals represent real investment.

Shifting Investment Models: A Sectoral Comparison

Most importantly, Syria’s investment philosophy is undergoing a qualitative shift. Foreign engagement is moving away from a conflict-era model rooted in extraction and political leverage toward more balanced economic and developmental partnerships tied to local capacity-building, institutional strengthening, and broader regional openness.

The phosphate sector under Assad illustrates the earlier model. Foreign-backed projects, led by the sanctioned Russian firm Stroytransgaz, focused on mining and exporting raw materials under an unequal profit-sharing arrangement that granted 70 percent of revenues to the Russian side. For comparison, the IMF notes that governments in extractive industries typically capture the majority of economic rent—often 50–70 percent—placing Syria’s 30 percent share well below common practice. Following the political transition, the fate of these phosphate contracts remains uncertain.

In contrast, Saudi-linked proposals—particularly those associated with the Elaf Fund—and Emirati commitments reflect a fundamentally different approach. Official statements emphasize developing full value chains, including domestic fertilizer production and technology transfer from firms such as Saudi Arabia’s Maaden. Similarly, the award of the Tartous Port management contract to the UAE’s Dubai Ports (DP) World, which began operations in mid-November 2025, is widely viewed as a positive signal: DP World is a reputable global operator with a strong record of delivering large-scale port infrastructure.

In the energy sector, the contrast is even sharper. During the war, companies such as Evro Polis operated under arrangements that granted them 25 percent of revenues from oil and gas fields captured by the Wagner Group—a model in which military or security support appeared to be exchanged for production rights. The company’s internationally sanctioned status further isolated Syria from global markets. Today, however, new announcements suggest a potential pivot toward less extractive and more sustainable models. Saudi Arabia’s ACWA Power has signed an MoU to develop up to 2.5 gigawatts of renewable energy capacity, framed around technology transfer and workforce training.

Telecommunications shows a similar break from conflict-era dynamics. Wafa Telecom—licensed in February 2022 as Syria’s third mobile operator—was presented as a local venture but later revealed, through investigations by the Observatory of Political and Economic Networks and OCCRP, to have ownership links to Iran’s Islamic Revolutionary Guard Corps. The project functioned more as a mechanism for settling debts and extending political influence than as a genuine commercial investment. By contrast, Saudi companies such as GO Telecom and STC have centered their roughly USD 1.1 billion in agreements on upgrading the sector’s foundations: digital infrastructure, fiber-optic expansion, cybersecurity, and data-center capacity.

Looking Ahead

Syria’s investment landscape is shifting not from self-interest to altruism but from wartime leverage to market-driven influence. Gulf and Turkish actors still pursue strategic and commercial objectives, yet they do so through instruments tied to profitability, regional integration, and reputation rather than military patronage or debt-swap arrangements.

The durability of this transition will depend less on who invests and more on the regulatory framework that governs them. A credible investment climate requires revisiting legacy Russian and Iranian contracts—many of which lack transparency or fair profit-sharing—and ensuring that all future agreements align with clear legal and economic standards.