Publications

Here we share all our published work, including peer-reviewed academic papers, policy papers, and op-eds.

Carnegie Middle East Center (Op-ed), Karam Shaar and Armenak Tokmajyan (Dec 11, 2019)

On October 6, President Donald Trump announced the withdrawal of U.S. forces from Syria as he declared victory over the Islamic State. Yet under bipartisan pressure in the United States, Trump soon backpedalled on the U.S. pullout. This was the second time in less than a year that he had done so. This time, Trump’s justification was that U.S. forces would stay to “take Syria’s oil”. This article argues that taking Syria’s oil is simply an excuse for the president’s decision to backtrack on the withdrawal as it is hardly economically feasible.

Middle East Institute, Karam Shaar (Policy paper) (Aug 27, 2019)

Unlike most other goods, the inflation-adjusted prices of oil and oil derivatives actually became cheaper in the years after the Syrian uprising and the loss of most of the country’s oil fields. Iran stepped in to fill the gap by shipping oil by sea through the Suez Canal. In recent months, however, these shipments seem to have ground to a halt, crippling regime-controlled areas. This paper examines several competing explanations for the slowdown in Iranian oil shipments, explores a range of possible responses for the Assad regime, and takes a closer look at the implications for the regime, its allies, and regular Syrians.

Working Paper, Karam Shaar (Jan 1, 2019)

International trade data are filled with discrepancies–where two countries report different values of trade with each other. Dr Karam Shaar develops a novel trade data quality index for reconciling the discrepancies in bilateral trade data. He calculates the quality for each country’s imports and exports separately for every year from 1962 to 2016 and reconcile international trade data by picking the value reported by the country with higher data quality in every bilateral flow. The reconciled data reshape our views on international trade: (a) countries with low data quality under-report their imports and exports: low-quality reporters are 14% more open to trade using reconciled data; (b) corruption, the level of development, and erroneous reporting can explain data quality; (c) importers’ data are more accurate; (d) China tends to under-report its exports and over-report its imports, while there is only a small difference between US self-reported and reconciled data.

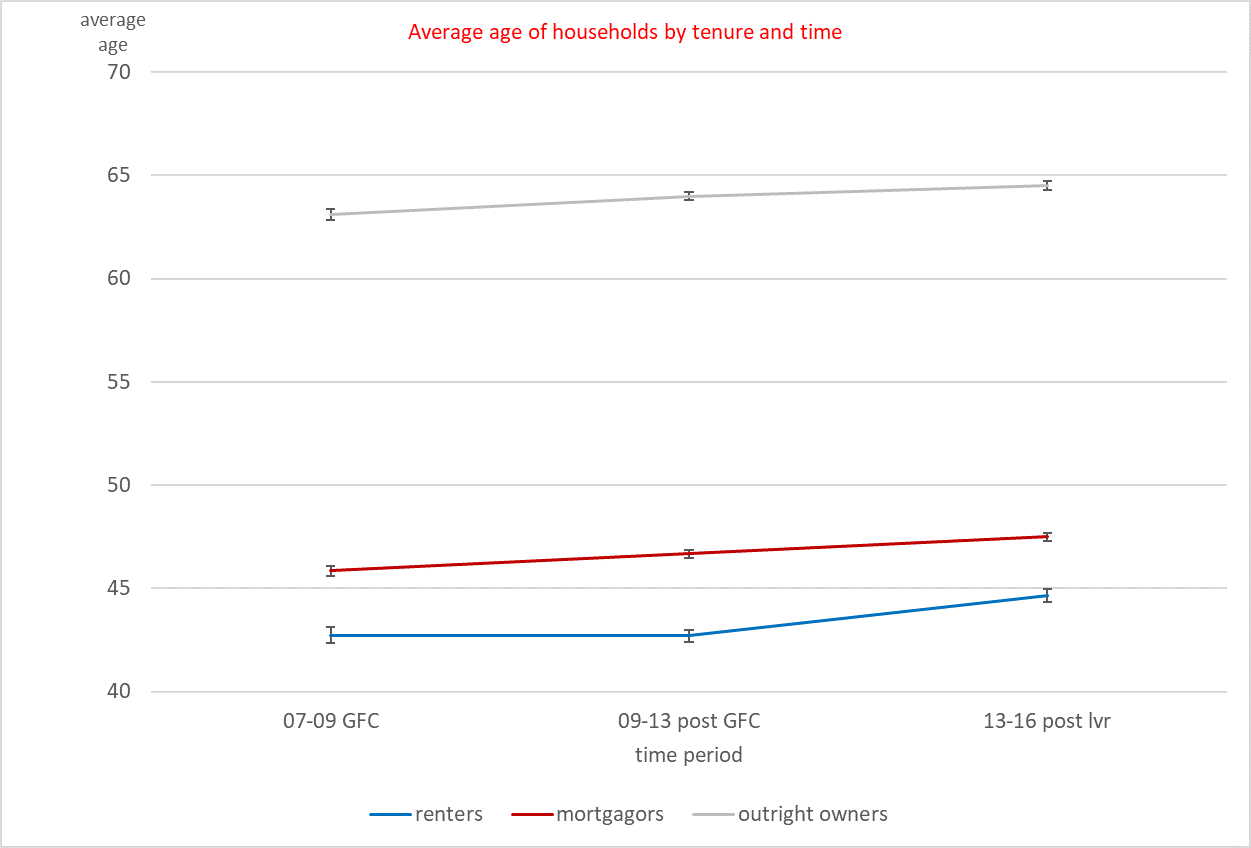

Reserve Bank of New Zealand, Karam Shaar (Policy paper) (Jul 16, 2018)

Mortgagors constitute a third of households in New Zealand, and the vulnerability of mortgagors to different risks impacts the financial system as a whole. In this study, Dr Karam Shaar uses Household Economic Survey (HES) microdata provided by Statistics New Zealand to assess changes in the vulnerability of new non-investor mortgagors from 2006 to 2016. The data also enables me to estimate ‘deposit affordability’ – the affordability of the equity required from households to purchase houses. His measure of affordability computes the number of years required to save a deposit given the Loan-to-Value rules that apply in the country as a whole or in a given locality.

Reserve Bank of New Zealand (Academic paper), Dr Karam Shaar and Dr Fang Yao (Apr 1, 2018)

This paper investigates how household debt affects the marginal propensity to consume out of housing wealth. Dr Karam Shaar and Dr Fang Yao use New Zealand household-level data on spending, income, and debt over the period 2006-2016. The main empirical challenge is to identify exogenous variation in house prices to determine how consumption evolves with movements in household wealth. This identification problem is complicated by the presence of unobserved household characteristics that are correlated with housing wealth. They also use a detailed house sale dataset to derive local average house prices and use it as an instrument. Their empirical results show that the estimated elasticity of consumption spending to housing wealth is about 0.22%. In dollar terms, the average marginal propensity to consume out of a one-dollar increase in housing wealth is around 2.2 cents. Furthermore, their empirical results also confirm that household indebtedness, especially via mortgage debt, acts as a drag on consumption spending, not only through the debt overhang channel, but also through influencing the collateral channel of the housing wealth effect.